|

Louisiana Light • 2 days | 73.02 | -0.64 | -0.87% | ||

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% | ||

|

Mars US • 321 days | 75.54 | -1.36 | -1.77% | ||

|

Gasoline • 16 mins | 2.052 | -0.008 | -0.37% |

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Girassol • 31 days | 79.56 | -1.80 | -2.21% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% |

|

Peace Sour • 11 hours | 66.88 | -0.08 | -0.12% | ||

|

Light Sour Blend • 11 hours | 66.13 | -0.08 | -0.12% | ||

|

Syncrude Sweet Premium • 11 hours | 70.88 | -0.08 | -0.11% | ||

|

Central Alberta • 11 hours | 67.88 | -0.08 | -0.12% |

|

Eagle Ford • 2 days | 67.39 | -0.28 | -0.41% | ||

|

Oklahoma Sweet • 2 days | 67.50 | -0.25 | -0.37% | ||

|

Kansas Common • 3 days | 58.02 | +1.10 | +1.93% | ||

|

Buena Vista • 3 days | 77.67 | +1.10 | +1.44% |

Does OPEC Still Hold Sway Over U.S. Oil Markets?

OPEC's continued influence on US…

Washington Reacts To Russia's Kursk Counteroffensive

The wider development is that…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

U.S. Crude, Product Inventory Builds Set To Deliver Cheap Gas For Holidays

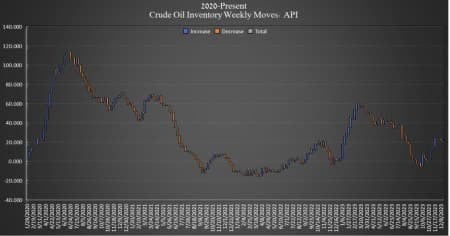

By Julianne Geiger - Dec 19, 2023, 3:40 PM CSTCrude oil inventories in the United States rose this week by 939,000 barrels for the week ending December 15, according to The American Petroleum Institute (API), after a 2.349-million-barrel draw in crude inventories in the week prior. Analysts had expected inventories to fall by 2.233 million barrels.

API data shows a net build in crude oil inventories in the United States of just over 18 million barrels so far this year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 600,000 barrels. Inventories are now at 352.5 million barrels, with total purchases for the SPR totaling nearly 6 million barrels since the Biden Administration began its buyback program.

Oil prices were trading up ahead of API data release as the year draws close to the end. At 12:25 pm ET, Brent crude was trading up 1.59% at $79.19—nearly $6 per barrel more than where it was this same time last week. The U.S. benchmark WTI was trading up on the day by 1.71% at that time, at $79.28–more than $10 per barrel up from this time last week.

More Top Reads From Oilprice.com:

- The U.S. Wants to Halve Russia’s Oil and Gas Revenues by 2030

- Oil Revenues Send Alberta’s Budget Surplus Soaring

- Consumer Reports: EVs Are Less Reliable Than Gasoline Cars

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com

- why is the data "set to deliver cheap gas for the holidays" if prices are trending up ? the data was released on yesterday before tuesdays breakout day for oil.

seems like misleading title