Breaking News:

Why the EU is Falling Behind in the Global AI Race

The European Union's regulatory policies…

Oil Prices Resume Post-Cut Rally Despite Demand Doubts

Crude oil prices rise after…

Washington Not Likely To Lower Russian Oil Price Cap–Yet

As Europe discusses the possibility of further lowering the G7’s $60 price cap on Russian crude oil to squeeze Kremlin coffers more, Bloomberg is citing unnamed sources as saying that the Biden administration would likely oppose such a move.

The price cap implemented on December 5 is slated for review every two weeks, which is next week, at which point market conditions are considered to ensure that the price cap remains at least 5% below average prices.

Poland and Lithuania are seeking to lower the price cap on Russian oil below $60 and are also pushing for sanctions targeting Russia’s nuclear industry, Reuters reported. Estonia has also pushed for a lower price cap.

On February 5, an additional price cap on Russian refined oil products will come into force, and according to Bloomberg sources, the Biden administration would prefer to wait to see the impact of this before considering any changes to the December 5 price cap, which require unanimity.

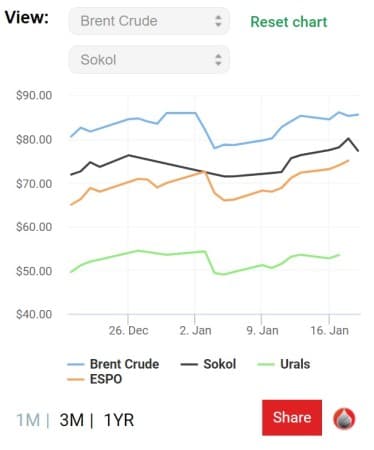

Russian Urals crude is now trading well below international prices.

According to CEPA (the Center for European Policy Analysis), “complications in trading Russian oil, in particular, have now resulted in a large (30%-40%) discount being applied to Russian oil. The oil price cap might have been set at $60, but the Urals oil blend is now trading significantly lower than this.”

The net results, Timothy Ash writes for CEPA, is that “Russia has lost more than half the physical volume of its former gas sales to Europe, and prices of gas in Europe are now back to pre-February levels. This could potentially see Russia lose $50bn in annual business in 2023”.

This counters initial criticism of the cap scheme by several politicians, including former U.S. Treasury Secretary Steve Mnuchin who described the cap idea as “not only not feasible”, but “the most ridiculous idea I’ve ever heard”.

So far, Russia has responded by placing a ban on the purchase of Russian crude and petroleum products for five months from any country obeying the cap.

ADVERTISEMENT

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com:

- Why 2023 Will Be Another Strong Year For The Oil Industry

- EIA: Soaring Production Will Keep Natural Gas Prices In Check

- Saudi Arabia Is Open To Discuss Non-Dollar Oil Trade Settlements

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B