Breaking News:

U.S. Oil and Gas Rig Count Jumps

The total number of active…

Asian Markets Are Backbone of Success for Canada’s New Oil Pipeline

TMX crude is gaining interest…

WCS Prices Jump As Canadian Wildfires Threaten Heavy Oil Supply

Wildfires in Canada are sending Canadian oil prices higher as a second oil producer is forced to shut-in production, with Cenovus Energy joining Canadian Natural Resources in halting operations due to safety concerns, according to World Oil.

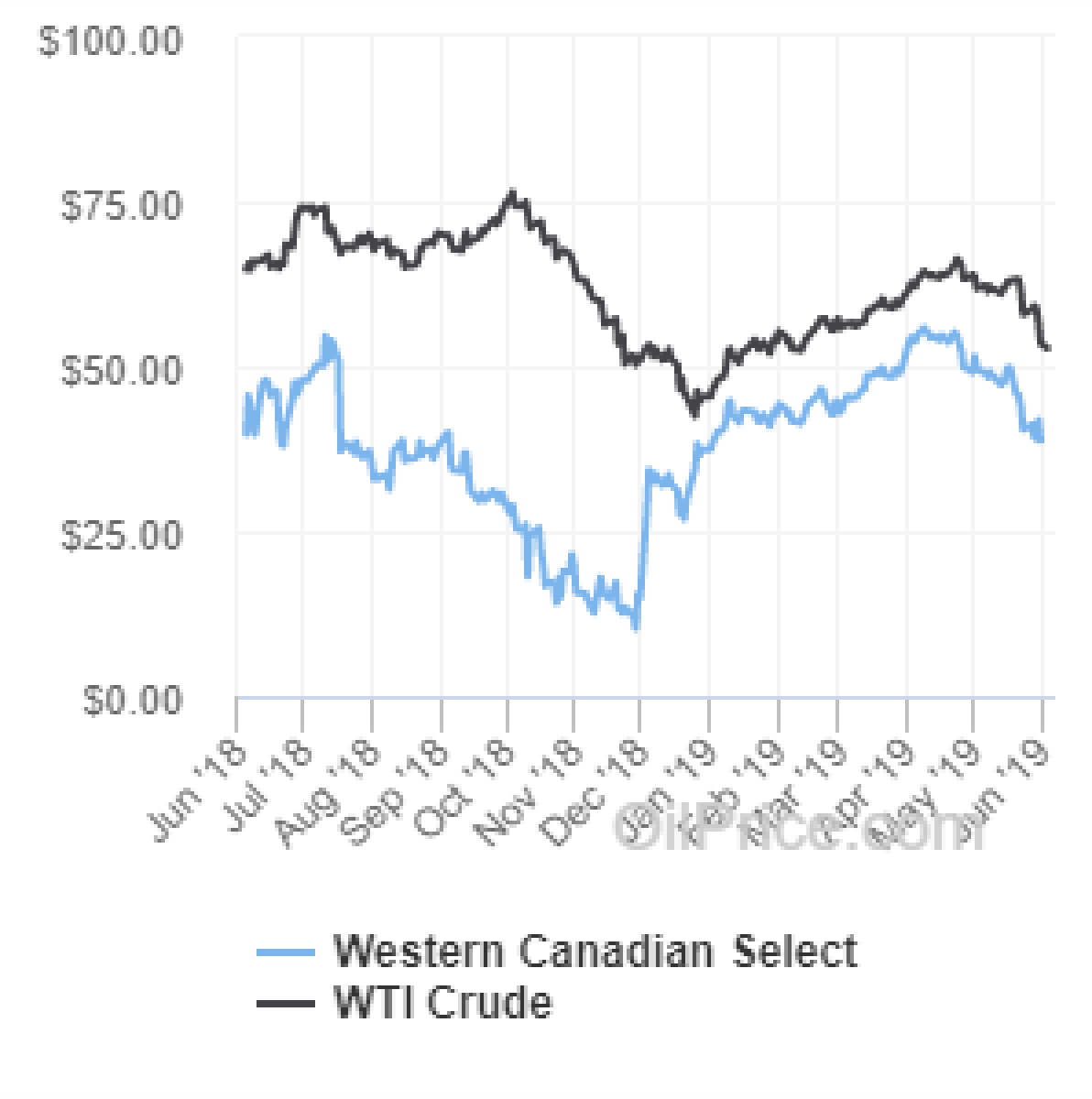

Over the past year, Canada’s oil industry has suffered under the weight of its deeply discounted benchmark crude oil, Western Canadian Select. The painful discount, worsened by Canada’s provincial bickering over oil flows and pipeline projects, pressured oil-rich Alberta last year curtail oil production in an effort to shore up the discount. It worked.

In October 2018, the WCS discount was over $60.

That discount fell to just $15 last week, and is now looking to shrink even further thanks to the wildfire.

The wildfires bring back painful memories of wildfires ripping through Alberta in 2016, crippling multiple producers and shutting in hundreds of thousands of barrels of production. The total estimated cost of those fires were $1 billion. The wildfire damage was so far reaching, that it affected global oil prices as well.

The latest wildfire has so far claimed just the two producers. The first of which is Canadian Natural Resources LTD (NYSE: CNQ), which has seen a drop in stock price of 1.44% to trade at $26.60. Cenovus Energy Inc. (NYSE: CVE) was trading down 1.71% at $8.06.

Canadian Natural Resources have stopped 65,000 barrels daily of heavy crude oil—a resource that at the moment is already constrained as Venezuela’s crude oil production—which is of the heavy variety—has dropped to new lows. Iran’s oil too—also heavy—is also being restricted.

ADVERTISEMENT

US Gulf refineries are configured to process his heavy crude oil, which is becoming increasingly difficult (or increasingly expensive) to find, and driving season is now underway. Most refineries ramp up production for driving season, but the global shortage of heavy crude oil—made worse by the wildfires—will surely cut into refinery margins.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Iraq’s Ambitious Oil Plan Faces One Major Problem

- The Second Machine Age Could Crash Oil Prices

- Peace And Oil: Trump’s Endgame In Saudi Arabia

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B