|

Louisiana Light • 2 days | 73.02 | -0.64 | -0.87% | ||

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% | ||

|

Mars US • 321 days | 75.54 | -1.36 | -1.77% | ||

|

Gasoline • 11 mins | 2.054 | -0.006 | -0.31% |

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Girassol • 31 days | 79.56 | -1.80 | -2.21% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% |

|

Peace Sour • 10 hours | 66.88 | -0.08 | -0.12% | ||

|

Light Sour Blend • 10 hours | 66.13 | -0.08 | -0.12% | ||

|

Syncrude Sweet Premium • 10 hours | 70.88 | -0.08 | -0.11% | ||

|

Central Alberta • 10 hours | 67.88 | -0.08 | -0.12% |

|

Eagle Ford • 2 days | 67.39 | -0.28 | -0.41% | ||

|

Oklahoma Sweet • 2 days | 67.50 | -0.25 | -0.37% | ||

|

Kansas Common • 3 days | 58.02 | +1.10 | +1.93% | ||

|

Buena Vista • 3 days | 77.67 | +1.10 | +1.44% |

An End To a Four-Week Losing Streak for Oil?

This week, crude oil prices…

Chevron CEO: Biden's LNG Moratorium Fails on All Fronts

Chevron CEO Mike Wirth criticizes…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

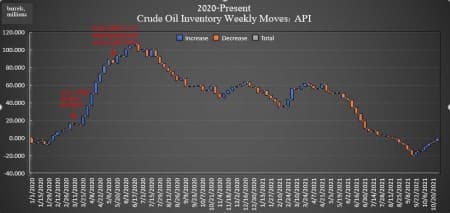

Sixth Straight Crude Inventory Build Tempers Prices

By Julianne Geiger - Nov 02, 2021, 3:52 PM CDTThe American Petroleum Institute (API) on Tuesday reported its sixth straight week of crude oil inventory builds. This week, the API estimated the inventory build for crude oil to be 3.594 million barrels. But it’s the Cushing inventory yet again that is stealing the show this week.

Despite the six weeks of builds, U.S. crude inventories are still 57 million barrels below where they were at the beginning of the year.

Analyst expectations for the week were for a build of 1.567-million barrels for the week.

In the previous week, the API reported a build in oil inventories of 2.318-million barrels, compared to the 1.650-million-barrel build that analysts had predicted.

Oil prices were trading down on Tuesday in the runup to the data release, with WTI sinking to $83.52 and Brent trading around $84.52 per barrel. Both WTI and Brent were down .62% and .22%, respectively, at 4:27 p.m. EST.

U.S. oil production for the week ending October 22—the last week for which the Energy Information Administration has provided data—stayed the same at 11.3 million bpd—still 1.8 million bpd below the all-time high of 13.1 million bpd reached right before the pandemic took hold in the United States.

The API reported a draw in gasoline inventories of 552,000 barrels for the week ending October 29—compared to the previous week's 530,000-barrel build.

Distillate stocks saw an increase in inventories of 573,000 barrels for the week, on top of last week's 986,000-barrel increase.

Cushing inventories have already drawn down more than 30 million barrels so far this year.

ADVERTISEMENT

And this week, the API reported yet another draw, of 882,000 barrels, on top of last week's 3.734-million-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Money Managers Are Throwing Their Weight Behind The Oil Price Rally

- Pipeline Leak Disrupts Libya’s Oil Exports

- Who Will Win The Race For India’s Emerging EV Market?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com

Speaking of steam power..