|

Louisiana Light • 2 days | 73.02 | -0.64 | -0.87% | ||

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% | ||

|

Mars US • 321 days | 75.54 | -1.36 | -1.77% | ||

|

Gasoline • 19 mins | 2.059 | -0.001 | -0.03% |

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Girassol • 31 days | 79.56 | -1.80 | -2.21% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% |

|

Peace Sour • 8 hours | 66.88 | -0.08 | -0.12% | ||

|

Light Sour Blend • 8 hours | 66.13 | -0.08 | -0.12% | ||

|

Syncrude Sweet Premium • 8 hours | 70.88 | -0.08 | -0.11% | ||

|

Central Alberta • 8 hours | 67.88 | -0.08 | -0.12% |

|

Eagle Ford • 2 days | 67.39 | -0.28 | -0.41% | ||

|

Oklahoma Sweet • 2 days | 67.50 | -0.25 | -0.37% | ||

|

Kansas Common • 3 days | 58.02 | +1.10 | +1.93% | ||

|

Buena Vista • 3 days | 77.67 | +1.10 | +1.44% |

Solar Pumps Poised to Revolutionize Global Water Access

Solar-powered water pumps have the…

Russian Oil Refining Capacity Plummets 14.5%

Russia's oil refining capacity has…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

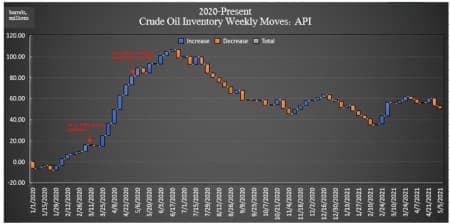

Oil Prices Bolstered By Crude Inventory Draw

By Julianne Geiger - May 11, 2021, 3:56 PM CDTThe American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 2.533 million barrels for the week ending May 7.

Analysts had predicted a draw of 2.817 million barrels for the week.

In the previous week, the API reported a massive draw in oil inventories of 7.688 million barrels after analysts had predicted a draw of 2.346 million barrels. Since the start of 2020, crude oil inventories have grown by more than 50 million barrels, according to API data.

Oil prices were trading up on the day prior to the data release as OPEC’s oil demand forecast remained unchanged in the latest edition of its MMOR and as the Colonial Pipeline outages cause Gulf Coast refiners to curb production.

At 3:23 p.m. EDT, WTI traded at $65.47, or 0.85% up on the day and roughly $0.20 lower per barrel than this time last week. Brent crude traded up at $68.72 per barrel or 0.59% up on the day.

While crude oil inventories fell this week, U.S. oil production was unchanged at 10.9 million bpd on average for the week ending April 30, according to the latest data from the Energy Information Administration.

The API reported a build in gasoline inventories of 5.640 million barrels for the week ending May 7—more than offsetting the previous week's 5.308 million barrel draw. Analysts had expected a 600,000 barrel draw for the week.

Distillate stocks saw a decrease in inventories this week of 872,000 barrels for the week, after last week's 3.453-barrel decrease.

Cushing inventories fell this week by 1.209 barrels.

ADVERTISEMENT

Post data release, at 4:35 p.m. EDT, the WTI benchmark was trading at $65.41 while Brent crude was trading at $68.67 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Big Oil Hikes Dividends After Blowout Quarter

- The Wider Ramifications Of A China-Aramco Deal

- Oil Investment Lags Jump In Crude Prices

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com