Breaking News:

Critical Minerals: The New Battleground for Economic Supremacy

The supply chain for strategic…

IEA Slashes Oil Demand Growth Forecast

The International Energy Agency (IEA)…

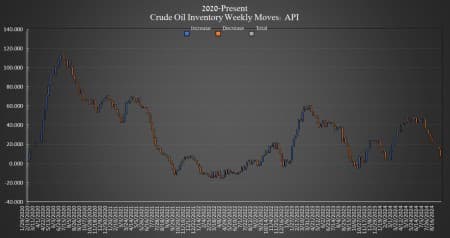

API Reports Significant Crude Draw, Cushing Inventories Drop

Crude oil inventories in the United States fell by a staggering 7.4 million barrels for the week ending August 30, according to The American Petroleum Institute (API). Analysts had expected a far smaller 900,000-barrel dip.

For the week prior, the API reported a 3.4-million-barrel decrease in crude inventories.

So far this year, crude oil inventories are more than 2 million barrels under where they were at the start of the year, having decreased by 10 million barrels, according to API data.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by another 1.8 million barrels as of August 30. Inventories are now at 379.7 million barrels.

Oil prices continued their decline on Wednesday ahead of the API data release. At 4:09 pm ET, Brent crude was trading down another $1.37 (-1.86%) on the day at $72.38—bringing the total loss to more than $7 per barrel from last Tuesday as disappointing economic data out of the United States and China spooked markets. The U.S. benchmark WTI was also trading down on the day by $1.48 (-2.10%) at $68.84—down nearly $7 per barrel from last Tuesday.

Gasoline inventories also fell this week, by 300,000 barrels, on top of last week’s 1.86-million-barrel decrease. As of last week, gasoline inventories are 3% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell also, by 400,000 barrels, on top of last week’s 1.4-million-barrel decrease. Distillates were already about 10% below the five-year average for the week ending August 23, the latest EIA data shows.

ADVERTISEMENT

Cushing inventories completed the draws, with a loss of 800,000 barrels, according to API data, which add onto the 486,000-barrel draw from the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com

- UAE’s State Oil Giant ADNOC Issues First-Ever Bond

- Controversy Surrounds Kazakhstan's Nuclear Referendum

- India Proposes Anti-Dumping Duties on Chinese Aluminum Foil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B