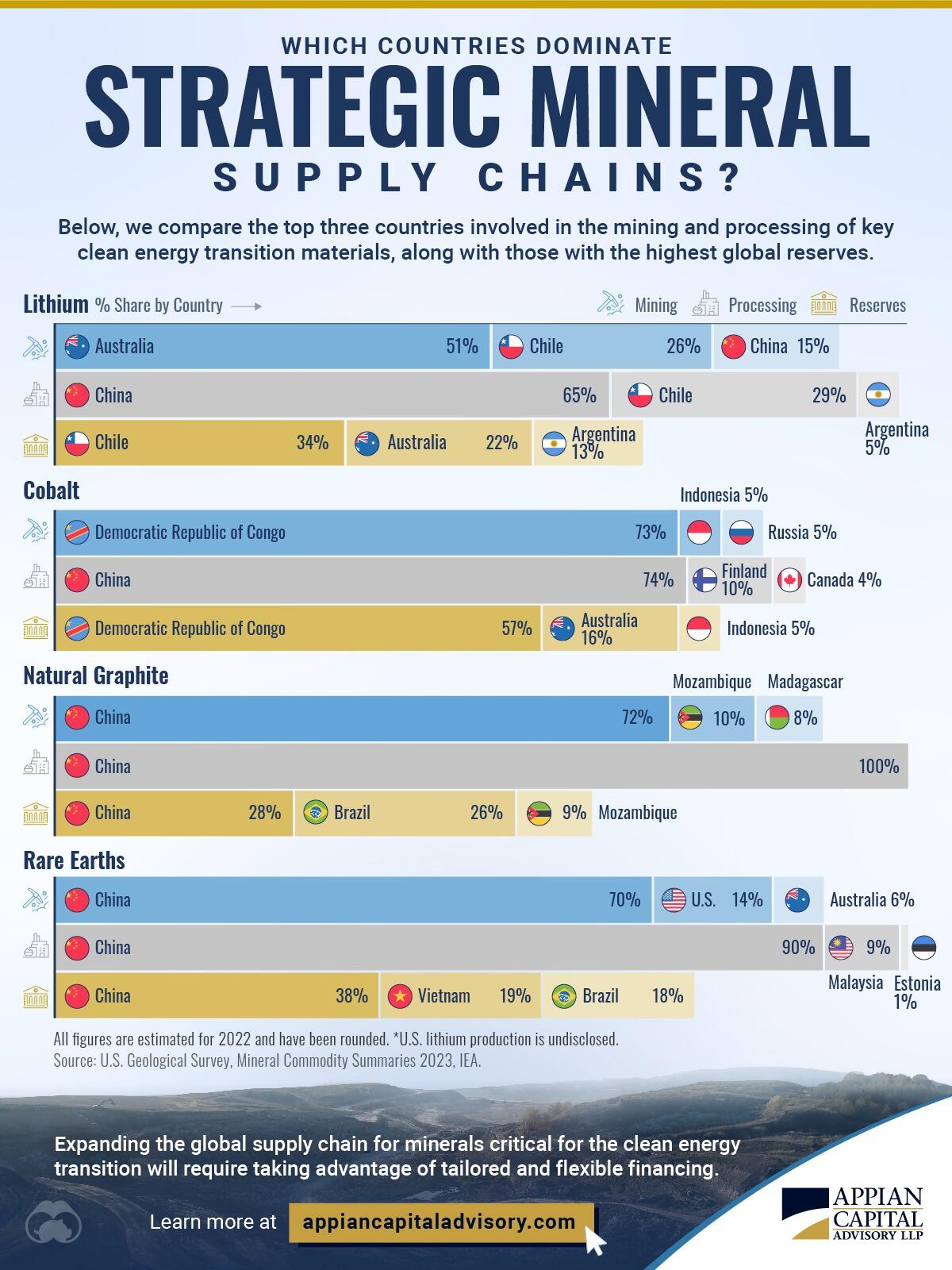

As the energy transition continues, tapping into the reserves of critical minerals and securing their supply chains is crucial.

For this graphic, Visual Capitalist partnered with Appian Capital Advisory to provide visual context to the top countries for reserves, production, and processing of minerals that are vital to the energy transition.

The analysis uses data from the USGS and the IEA across four minerals: lithium, cobalt, natural graphite, and rare earths.

Which Countries Hold the Most Critical Minerals Reserves?

South America dominates the reserves for lithium, with nearly half of all known reserves located in Chile (34%) and Argentina (13%). Australia, with 22% of global lithium reserves, is in third place.

The Democratic Republic of Congo is home to the highest share of cobalt reserves, at 57%. Australia, at 16%, also possesses a sizable source of the metal.

Natural graphite reserves are relatively spread out geographically. China (28%) and Brazil (26%) hold comparable amounts. Mozambique (9%) rounds out the top three list.

Rare earth minerals are primarily located in Asia, with China (38%) and Vietnam (19%) holding the greatest reserves. Brazil has 18% of known global reserves.

The Production and Processing of Critical Minerals

Overwhelmingly, China is the main hub for processing critical minerals across the board. The country is responsible for processing 65% of global lithium mined, 74% of cobalt, 100% of natural graphite, and 90% of rare earths.

Similarly, mine production is also fairly concentrated. This represents a potential risk to supply chain stability. For each mineral, over half of production occurs in a single country.

For lithium, the top-producing country is Australia (51%) and for cobalt it is the Democratic Republic of Congo (73%). Meanwhile, China produces the highest share of both natural graphite (72%) and rare earths (70%).

ADVERTISEMENT

Future-Proofing the Supply of Critical Minerals

Expanding the global supply chain for minerals that are vital to the clean energy transition will require investing in new mining projects, particularly in countries with high reserves but low production and processing rates.

By Zerohedge.com

More Top Reads From Oilprice.com

- Why Silver is the Unsung Hero of the Modern World

- Futures Point to Spike in U.S. Natural Gas Prices in 2025

- Rystad: Germany Set To Generate 80% of Electricity With Renewables by 2030