|

Louisiana Light • 2 days | 73.02 | -0.64 | -0.87% | ||

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% | ||

|

Mars US • 321 days | 75.54 | -1.36 | -1.77% | ||

|

Gasoline • 11 mins | 2.054 | -0.006 | -0.31% |

|

Bonny Light • 31 days | 78.62 | -2.30 | -2.84% | ||

|

Girassol • 31 days | 79.56 | -1.80 | -2.21% | ||

|

Opec Basket • 2 days | 73.65 | +0.08 | +0.11% |

|

Peace Sour • 10 hours | 66.88 | -0.08 | -0.12% | ||

|

Light Sour Blend • 10 hours | 66.13 | -0.08 | -0.12% | ||

|

Syncrude Sweet Premium • 10 hours | 70.88 | -0.08 | -0.11% | ||

|

Central Alberta • 10 hours | 67.88 | -0.08 | -0.12% |

|

Eagle Ford • 2 days | 67.39 | -0.28 | -0.41% | ||

|

Oklahoma Sweet • 2 days | 67.50 | -0.25 | -0.37% | ||

|

Kansas Common • 3 days | 58.02 | +1.10 | +1.93% | ||

|

Buena Vista • 3 days | 77.67 | +1.10 | +1.44% |

Oil Moves Higher on Surprise Crude Draw

Crude oil prices ticked higher…

Report Raises Alarm Over Chinese Electric Vehicle Data Collection

A new report warns that…

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

50% Of Hard-Rock Miners Are Losing Money As Lithium Prices Slump

By MINING.com - Sep 02, 2020, 11:30 AM CDTInvestment in battery manufacturing plants and electric vehicle factories continues to boom around the world, but for now the market for lithium shows no signs of emerging from its multi-year slump.

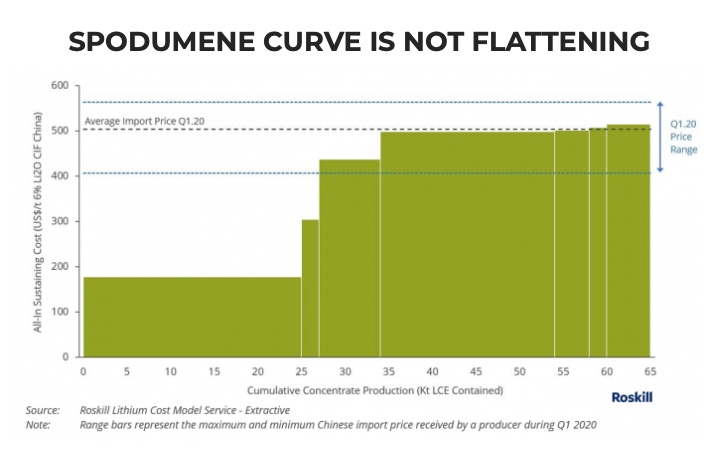

Hard rock miners have been hardest hit, with the price of spodumene concentrate (feedstock for lithium hydroxide manufacture) continuing to fall on the back of break-neck expansion in Australia, which quickly became the number one producer of lithium over South American brine producers.

Oversupply and a soft downstream industry in China, responsible for as much as 80% of global processing, have seen chemical-grade spodumene prices average just over $500 a tonne (6% Li CIF China) in the first quarter according to Roskill, a London-based metals and minerals researcher.

Roskill says, in a new industry outlook to 2030 report, this average is slightly misleading because Greenbushes, the largest and highest-grade mine of its kind, receives higher prices for its material owing to the integrated nature of the operation.

Excluding Greenbushes, the average spodumene import price into China was just $436 per tonne according to Roskill data, putting a full 50% of hard rock miners in a marginal to loss-making position on an all in sustaining cost basis during Q2:

Roskill is forecasting spodumene prices to remain subdued for the next 12-18 months – many producers look set to remain under pressure.

“Collectively, they face the dilemma of upping production (and utilisation rates) to generate the economies of scale needed to lower their cost base, while not exacerbating an already oversupplied market and deepening and/or prolonging the situation.”

ADVERTISEMENT

By Mining.com

More Top Reads From Oilprice.com:

- Russia Wants OPEC+ To React To Oil Demand Recovery

- Oil Prices Jump On Major Hurricane-Driven Crude Draw

- OPEC Production Rises By 950,000 Bpd In August

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Related posts

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com