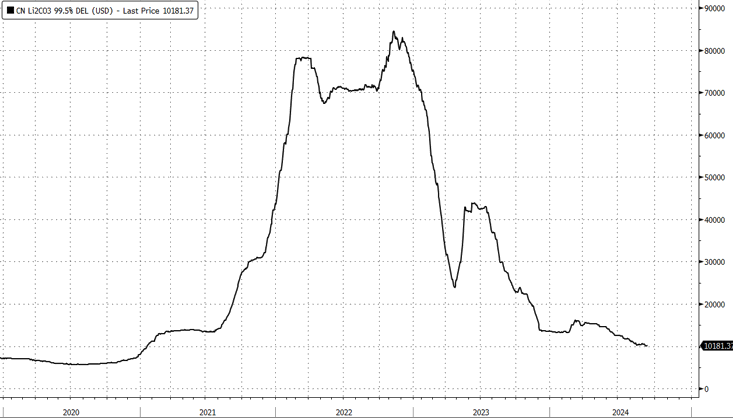

Goldman analysts Trina Chen and Joy Zhang explained in a client note Thursday that reports of Chinese battery giant Contemporary Amperex Technology (CATL) cutting lithium production at a major mine in Jiangxi province could produce a "near-term" price floor amid a multi-year bear market, temporarily alleviating oversupply concerns for the critical battery metal. However, they emphasized that the overall outlook for the lithium cycle remains deeply "negative."

"While there is lack of clarity on the quantification of production cut, we estimate the potential impact on global supply would be 3.9% for 2024E, and 5.2% for 2025E, if assuming a full production cut," the analysts said, referring to a Reuters headline specifying CATL plans to adjust its lithium production.

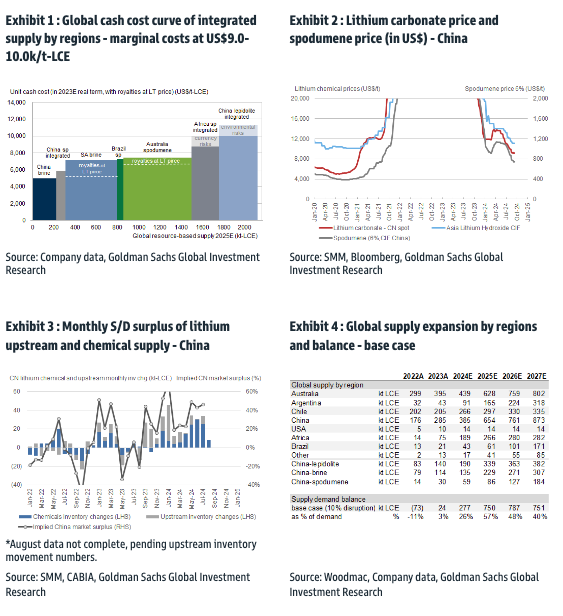

They said, "In the meantime, we expect the global supply surplus in the integrated lithium carbonate market to reach 26% for 2024E and 57% for 2025E. Thus, we do not view the production cut, along with a few other recently announced ones, would reverse the negative outlook of the global S/D balance."

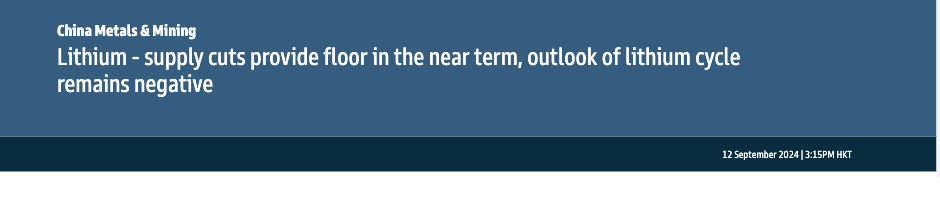

"Our work (on the global cost curve suggests the marginal cost of integrated lithium carbonate remains at US$9.0k-10.0k/t-LCE, and potentially lower driven by continued cost-cutting effort by Chinese producers, based on feedback over 1H24. While the production cut can provide support to the floor of the pricing in the near term, we remain more focused on cuts in development projects that are required to drive fundamental changes in S/D outlook. And the current spot price of US$9,174/t-LCE may still not be deep enough to trigger meaningful responses," the analysts noted.

The end of the note included a chart pack showing that oversupplied conditions have depressed prices.

While Goldman isn't too convinced lithium prices will bounce from here on CATL news, UBS analyst Sky Han told clients Wednesday that the latest development from CATL may suggest an 11%—23% upside in the Chinese lithium price for the rest of the year.

The key question is whether the development at CATL is enough supply coming out of the market to reverse prices. Another question: When will EV demand rebound?

ADVERTISEMENT

By Zerohedge.com

More Top Reads From Oilprice.com

- Saudi Arabia Set To Boost Crude Oil Supply to China in October

- U.S. Gasoline Prices Set to Drop Below $3 Before Election Day

- Uzbekistan Leverages Russia's Need for Allies, Secures Discounted Gas