|

Louisiana Light • 2 days | 73.66 | +0.86 | +1.18% | ||

|

Bonny Light • 30 days | 78.62 | -2.30 | -2.84% | ||

|

Opec Basket • 2 days | 73.57 | +0.80 | +1.10% | ||

|

Mars US • 320 days | 75.54 | -1.36 | -1.77% | ||

|

Gasoline • 10 mins | 2.022 | +0.011 | +0.57% |

|

Bonny Light • 30 days | 78.62 | -2.30 | -2.84% | ||

|

Girassol • 30 days | 79.56 | -1.80 | -2.21% | ||

|

Opec Basket • 2 days | 73.57 | +0.80 | +1.10% |

|

Peace Sour • 14 hours | 66.96 | +0.94 | +1.42% | ||

|

Light Sour Blend • 14 hours | 66.21 | +0.94 | +1.44% | ||

|

Syncrude Sweet Premium • 14 hours | 70.96 | +0.94 | +1.34% | ||

|

Central Alberta • 14 hours | 67.96 | +0.94 | +1.40% |

|

Eagle Ford • 2 days | 67.67 | +1.10 | +1.65% | ||

|

Oklahoma Sweet • 2 days | 67.75 | +1.25 | +1.88% | ||

|

Kansas Common • 2 days | 58.02 | +1.10 | +1.93% | ||

|

Buena Vista • 3 days | 76.57 | +1.17 | +1.55% |

Why SMRs Are Taking Longer Than Expected to Deploy

Small Modular Reactors (SMRs) offer…

Solar Pumps Poised to Revolutionize Global Water Access

Solar-powered water pumps have the…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related News

- Russia’s Oil Revenues Have Dropped by 30% Since June

- India Will Continue to Buy Cheap Russian Crude Oil

- Natural Gas Executives Clash With U.S. Officials Over Biden’s Energy Policies

- India Set to Account for 35% of Global Energy Demand Growth in Coming Decades

- How Israel Planted Explosives in Thousands of Hezbollah Pagers

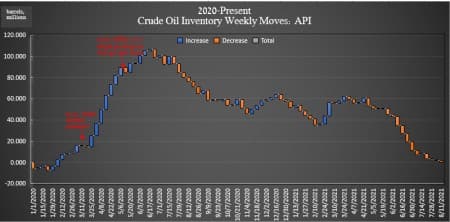

Oil Markets Unimpressed By Small Crude, Products Draw

By Julianne Geiger - Aug 17, 2021, 4:01 PM CDTThe American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 1.163 million barrels for the week ending August 13, bringing the total 2021 crude draw so far to more than 56 million barrels, using API data.

Analysts had expected a loss of 1.259 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 816,000 barrels—a loss smaller than the 1.050 million barrel draw that analysts had predicted.

The price of a WTI barrel had fallen earlier on Tuesday—rounding out the fourth day of consecutive losses and the longest losing streak since March.

WTI lost more than 1% on Tuesday afternoon leading up to the data release.

At 3:00 p.m. EST, WTI was trading at $66.58—a $.50 loss on the day and $2 per barrel loss on the week. Brent crude was trading down 0.45% for the day at $69.20.

While U.S. crude oil stocks continue their decline, U.S. oil production has slowly risen from 11 million bpd at the start of the year to 11.3 million bpd now—an increase of 100,000 bpd for the week.

The API reported a draw in gasoline inventories of 1.1979 million barrels for the week ending August 13—compared to the previous week's 1.114-million-barrel draw.

Distillate stocks saw an increase in inventories this week of 502,000 barrels for the week, compared to last week's 673,000-barrel increase.

ADVERTISEMENT

Cushing inventories fell this week by 1.735 million barrels, after last week's 413,000-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Main Reason Oil Prices Won't Go Above $80 Per Barrel

- What Happens If We Stop Pumping Oil Tomorrow?

- Oil Sinks As Demand Outlook Worsens

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com