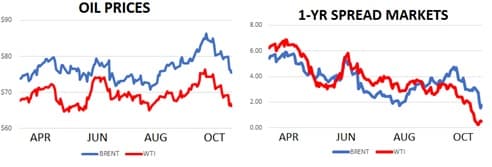

October has been a tough month for crude oil. WTI has dropped from $76 to $66 while Brent fell from $86 to $76. We started the month thinking that prices would exist in a tug of war between bullish supply/demand fundamentals and a bearish economic background and instead the market’s been served a relentless flow of bearish news for three straight weeks.

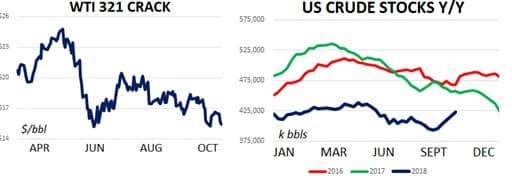

For supply/demand balances, the news flow has been focused on downgrades to 2019 demand forecasts and higher than expected supply gains in the United States. OPEC, the EIA and IEA all downgraded their expected refiner consumption for 2019 and China/U.S. trade disputes have added to concerns from analysts that the economic picture isn’t pretty. In the U.S., crude oil stocks have jumped by an incredible 29m bbls over the past five weeks. To put that in a seasonal context, inventories decreased by 6m bbls during the same period in 2016 and fell by 15m bbls during the same period in 2017. Much of the recent builds have been due to seasonal refiner maintenance but the more powerful force in the market for now seems to be that every key producer globally – with the exception of Iran and Venezuela – is pumping at record levels.

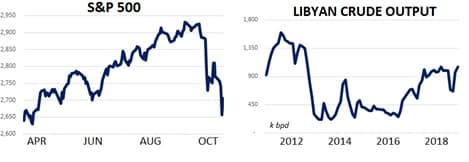

On the macro side we’ve been arguing for several months that a dimming growth outlook for 2019 would help keep a lid on prices. These concerns have been highlighted in October by falling global equity markets from Shanghai to New York which have been a primary driver…

October has been a tough month for crude oil. WTI has dropped from $76 to $66 while Brent fell from $86 to $76. We started the month thinking that prices would exist in a tug of war between bullish supply/demand fundamentals and a bearish economic background and instead the market’s been served a relentless flow of bearish news for three straight weeks.

For supply/demand balances, the news flow has been focused on downgrades to 2019 demand forecasts and higher than expected supply gains in the United States. OPEC, the EIA and IEA all downgraded their expected refiner consumption for 2019 and China/U.S. trade disputes have added to concerns from analysts that the economic picture isn’t pretty. In the U.S., crude oil stocks have jumped by an incredible 29m bbls over the past five weeks. To put that in a seasonal context, inventories decreased by 6m bbls during the same period in 2016 and fell by 15m bbls during the same period in 2017. Much of the recent builds have been due to seasonal refiner maintenance but the more powerful force in the market for now seems to be that every key producer globally – with the exception of Iran and Venezuela – is pumping at record levels.

On the macro side we’ve been arguing for several months that a dimming growth outlook for 2019 would help keep a lid on prices. These concerns have been highlighted in October by falling global equity markets from Shanghai to New York which have been a primary driver of oil’s selloff. So far on the month, the S&P has dropped by about 10% while the Euro Stoxx 50 is lower by about 9%. More than one-third of U.S. companies have also been discussing U.S./China tariffs as a future headwind on earnings calls over the last month.

It's clear that there’s a bearish chill in the air this month but we also think that market participants would be wise to remember some of the bullish themes which supported oil (and nearly sent it to $100) just one month ago. On the macro economic front, yes, it is true that there are headwinds facing growth scenarios in 2019 such as increased interest rates and threats to global trade. It’s also true, however, that interest rates remain well below historical norms and that even if global trade expands in small percentage terms next year, we can still expect global crude oil demand growth to exceed 1m barrels per day. We also think that traders should continue to watch the relentless supply growth coming from Libya and Nigeria with a skeptical eye as those nations head into crucial elections in the coming months which could be geopolitically disruptive. OPEC supply growth has been impressive in 2018, but we shouldn’t just assume it will progress skyward as Venezuela descends further into chaos and the Trump administration remains steadfast in imposing sanctions on Iran. Supply constraints should also become magnified in the coming months as US refiners return from fall turnaround maintenance and will increase their demand by nearly 2m bpd over the next two months. Last but not least, we think oil prices could be due for some technical support after falling more than 12% in just 16 trading sessions.

Looking ahead we’re sticking to our view that cooling global growth will make it very difficult for oil to cross north of $100 in the near future. However, there are still some bullish influences in the market which should protect against a massive downside move. October has seen an onslaught of negative news from a variety of angles but it would be premature to say that oil is going to flip into a steep bear market.

Quick Hits

- Brent crude oil bottomed out at $75.11 this week while WTI sank to a low of $65.74. On the news front there was more of the same- larger than expected inventory builds in the US while equity markets drove risk asset prices lower. Both grades have been hit by more than $10 so far in October but technical signs are suggesting to us that the move lower may be overdone. 20-day RSI shows that both grades are in oversold territory and WTI fell below its 200-Day Moving Average for the first time in more than a year. We think some short-covering and profit taking could give crude oil a near term bounce.

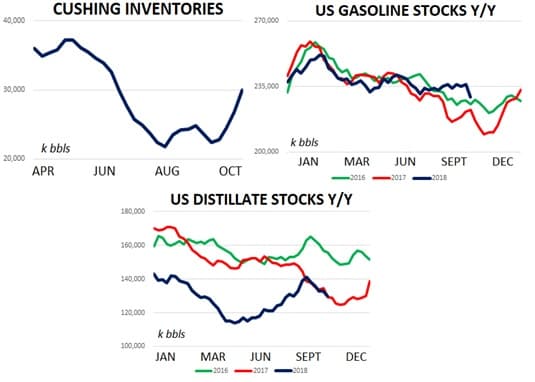

- Time spreads for both Brent and WTI are trading at year-to-date lows and certainly don’t support the idea that oil is quietly preparing for a renewed bull market. On the other hand, spreads for both grades remain comfortably backwardated which strongly suggest that global inventories can be expected to decline in the coming months. This week the December ’18 / December ’19 spreads for WTI remained 50 cents backwardated while the same spread for brent was $1.75 backwardated. WTI market pressure has largely come from the increase in crude supplies in Cushing (from 22m to 30m bbls in the last 6 weeks) while pressure on brent spreads has come from increased output from Nigeria, Libya and Saudi Arabia.

- Equities continued to nose dive this week and created a risk-off tone across markets. U.S. stocks were hit particularly hard with S&Ps falling to a 5-month low of 2,650 on Thursday for a near-300 point loss on the month. Emerging market stocks are showing severe stress and the MSCI Emerging Markets Index fell to a 19-month low on Thursday.

- Bond markets, meanwhile, were the beneficiary of the risk-off move in markets and yields moved broadly lower across fixed income. The US 10yr yield fell to 3.10% this week after reaching 3.24% earlier in the month. On a more positive note, copper prices were mostly flat on the week and are still about 8% higher than their YTD low which came in September.

- Recent production gains in Libya and Nigeria have been a key sources of bearishness for crude in the last few months. Libyan output is now running near a 5yr high and Nigeria production has jumped by about 250k bpd (to 1.8m bpd) since May. Unfortunately these production gains could be climbing a slippery slope heading into elections in both countries. We won’t be surprised to see headline-making disruptions come from either nation later in 2018

(Click to enlarge)

(Click to enlarge)

DOE Roundup

- This week’s DOE data was highlighted by fifth straight larger-than expected inventory build

- Overall crude stocks can be attributed somewhat to refiner turnarounds, but recent seasonal data suggests something more bearish is going on

- Gasoline inventories have looked bearish in the last two months but enjoyed a substantial decline last week

U.S. crude stocks added more than 6.3m bbls last week and have increased by 5.9m bbls per week for the last five weeks. Much of the recent inventory increase is simply due to recent refiner turnarounds which have removed more than 1m bpd from the market relative to August. The real bearish issue facing the US market, however, is that production has increased by an amazing 1.4m bpd so far in 2018 versus 2017 which is putting more barrels into Cushing. On the demand side, low margins could also dampen the return of refinery demand as cracks languish near $15/bbl.

(Click to enlarge)

U.S. gasoline stocks fell by about 5m bbls w/w to 222m bbls and are higher y/y by about 3%. U.S. distillate stocks fell to 130m bbls and are flat y/y. On the demand side, domestic consumption and exports for both distillates and gasoline are higher by 1.7% y/y so far in 2018.

(Click to enlarge)