It's been a volatile week in oil markets as concerns over Chinese demand pressured prices despite a decline in U.S. crude inventories and wildfires in Canada.

Friday, July 26th, 2024

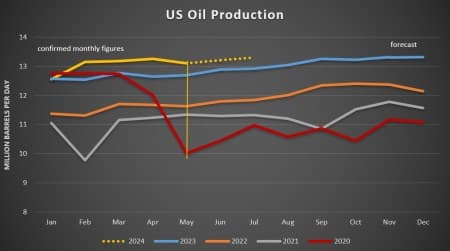

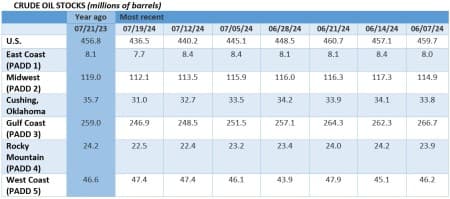

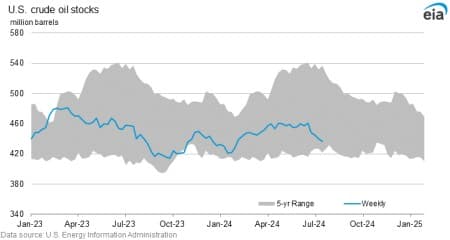

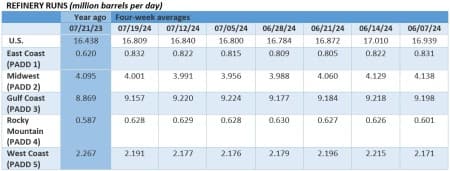

A rollercoaster of the week has left most market watchers guessing as to what might be coming up next for oil. Canada’s wildfires, continuously decreasing US oil stocks, and GDP figures in the States coming in well above expectations should have lifted sentiment, but the signals went mostly unnoticed amidst a widespread tech stock selloff and a commodity-wide disappointment in China. ICE Brent is set to finish the week below $82 per barrel, marking the third straight weekly decline.

Democrats Seek to Ban US Talking To OPEC. US Democratic lawmakers introduced a bill to hold energy companies accountable if they are found by federal regulators to have colluded with OPEC, suggesting such firms should be no longer eligible for new oil and gas leases on federal lands and waters.

Europe in Deadlock Amidst Ukraine Transit Row. Hungary and Slovakia have asked the European Commission to launch a consultation procedure with Ukraine after the latter sanctioned the two countries’ main Russian pipeline oil supplier Lukoil, raising the risk of potential refinery halts in Central Europe.

Shell Loses Interest in Scottish Wind. UK-based energy major Shell (LON:SHEL) is planning to sell development leases it won to build up to 5 GW of floating wind farms off the Scottish coast, potentially liquidating its participation in a joint venture with Iberdrola’s subsidiary Scottish Power.

Brazil Prepares to Buy Back Its Own Refinery. Brazil’s state oil firm Petrobras (NYSE:PBR) is finishing up due diligence for a bid on the 300,000 b/d Mataripe refinery that it sold only three years ago to the Abu Dhabi sovereign fund Mubadala for $1.65 billion, seeking to unwind the Bolsonaro-era divestments.

OPEC+ Overproducers Present Their Compensation Plans. Just in time before the August meeting of the JMMC, Iraq, Kazakhstan and Russia, the largest overproducers of OPEC+, presented their compensation plans to reduce production by a collective 2.284 million b/d between now and September 2025.

India’s Refining Giant Gets Exempted from Venezuela Sanctions. According to Bloomberg, India’s largest private refiner Reliance Industries has received approval from the Biden administration to resume importing crude oil from Venezuela despite the reinstatement of sanctions in April 2024.

Chinese Investors Cut Stakes in Indonesian Smelters. Chinese mining companies are seeking to reduce their stakes in Indonesian nickel smelters to make their products eligible for EV tax credits in the US as the IRA restricts tax cuts to those with not more than 25% ownership by a foreign entity of concern, which applies to China.

Equinor Wants Less UK Exposure. Norway’s national oil firm Equinor (NYSE:EQNR) is considering cutting its 80% stake in the UK’s largest untapped oil field Rosebank, saying it would prefer to bring the share in line with that of other assets as Britain’s new Labour government is set to hike windfall taxes.

ADVERTISEMENT

India Eyes Riches of the Indian Ocean. The UN-backed International Seabed Authority has issued two deep-sea exploration licenses for India (out of a total of 31), with New Delhi planning to start mining by the end of the decade despite having no previous seabed mining expertise.

White House Eyes 2035 Ban on Single-Use Plastics. The White House announced a new goal to phase out federal procurement of single-use plastics in food service operations, packaging, and events by 2027 and to eliminate the material from federal operations by 2035, triggering the ire of the US polymer industry.

Russia Wants to Build a Refinery in Cuba. Revisiting long-lost ties from the Soviet era, Russian authorities have suggested that the country’s state-owned enterprises could build a refinery in Cuba, a country that mostly burns its 50,000 b/d of heavy crude oil production for power generation.

Italian Oil Major Expands in East Africa. Italy’s national oil company ENI (BIT:ENI) was awarded the Angoche A6-C offshore block in the country’s northeast, with the African country’s state oil firm ENH taking 40% in the project, seeking to replicate the success of the $7 billion Coral South LNG project.

Iron Ore Plunges on China Weakness. The disappointment from China’s Third Plenary continues to weigh on industrial metals with iron ore dipping below the psychological level of $100 per metric tonne on the Singapore Exchange, worsened by negative steel margins and Beijing mandating new quality standards.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

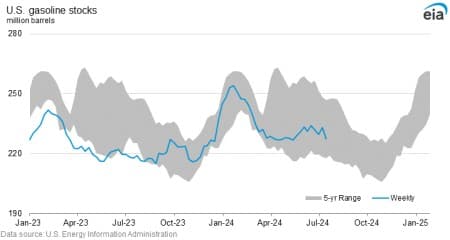

- U.S. Crude Oil Inventories Continue to Fall

- European Natural Gas Prices Fall as Freeport LNG Resumes Operations

- Major Automakers Returning to Gasoline Cars as EV Demand Slows