A plethora of factors contributed to crude moving up this week, with the EIA scaling back its US output estimate (cooling the bullish sentiment a bit), Saudi Aramco restating its firm commitment to keep the production curtailments as deep as the market conditions require, and most of all, the Venezuelan blackout blocked the exports capabilities of already sanctions-stricken PDVSA.

Tuesday’s trading environment was further buoyed by the American Petroleum Institute announcing a largely unexpected crude stock drop.

All in all, global benchmark Brent traded at around 67.3-67.5 USD per barrel on Wednesday afternoon, while WTI was drawing increasingly closer to 58 USD per barrel, having demonstrated an almost 2-percent growth on Wednesday. Should the current growth trend continue, both benchmarks would beat 4-month highs by the end of the week.

1. US Crude Inventories Bounce Back

- US commercial crude stocks rebounded robustly during the week ended March 01, increasing by 7.1 MMbbl to 452.9MMBbl.

- The inventory buildup was accompanied by a palpable decline in crude exports, by 0.6mbpd to 2.8mbpd, and an even more sizeable increase in crude imports to 7.0mbpd, up 1.1mbpd week-on-week.

- Refinery utilization seems to be edging higher for once, increasing 0.4 percent to 87.5 percent, with refinery input volumes higher by 0.1mbpd (at 16mbpd).

- Amid gasoline prices rising for the fifth consecutive week, gasoline stocks have decreased…

A plethora of factors contributed to crude moving up this week, with the EIA scaling back its US output estimate (cooling the bullish sentiment a bit), Saudi Aramco restating its firm commitment to keep the production curtailments as deep as the market conditions require, and most of all, the Venezuelan blackout blocked the exports capabilities of already sanctions-stricken PDVSA.

Tuesday’s trading environment was further buoyed by the American Petroleum Institute announcing a largely unexpected crude stock drop.

All in all, global benchmark Brent traded at around 67.3-67.5 USD per barrel on Wednesday afternoon, while WTI was drawing increasingly closer to 58 USD per barrel, having demonstrated an almost 2-percent growth on Wednesday. Should the current growth trend continue, both benchmarks would beat 4-month highs by the end of the week.

1. US Crude Inventories Bounce Back

- US commercial crude stocks rebounded robustly during the week ended March 01, increasing by 7.1 MMbbl to 452.9MMBbl.

- The inventory buildup was accompanied by a palpable decline in crude exports, by 0.6mbpd to 2.8mbpd, and an even more sizeable increase in crude imports to 7.0mbpd, up 1.1mbpd week-on-week.

- Refinery utilization seems to be edging higher for once, increasing 0.4 percent to 87.5 percent, with refinery input volumes higher by 0.1mbpd (at 16mbpd).

- Amid gasoline prices rising for the fifth consecutive week, gasoline stocks have decreased by 4.2MMbbl to 250.7MMbbl, edging closer to the statistical five-year range.

- Distillate inventories have dropped 2.4 MMbbl week-on-week to 136 MMbbl, marking a fourth consecutive, albeit relatively small, decline from January’s 143MMbbl peak.

- Early crude stock estimates for the week ending March 08 diverged with API predicting a 2.6 MMbbl drop, while the Platts analyst survey predicts a 3.3MMbbl build.

2. Iranian Discounts to Saudi Reach 20-Year Lows

- Iranian national oil company NIOC has hiked its April-loading official selling prices for Asia Pacific cargoes by 30 and 35 cents per barrels for Iranian Heavy and Iranian Light, respectively.

- This marks the largest gap between Iranian Light and Saudi rival grade Arab Light in 20 years, with Iranian Light now trading at a 0.45 USD per barrel discount even though traditionally it had been marketed at a premium to the Saudi crude.

- Similarly, Iranian Heavy is now at a 1.30 USD per barrel discount to Arab Medium, a 20-year low for the NIOC-marketed grade.

- Despite no commercial activity with NW-European counterparts since the onset of sanctions, NIOC cut NW Europe OSPs by a further 35 cents to -4.2 and -6.8 USD per barrel discounts, respectively for Iranian Light and Heavy.

- The Mediterranean witnessed the steepest cuts month-on-month with both grades’ OSP cut by 80 cents to -4.75 and -7.6 USD per barrel discounts for Iranian Light and Heavy.

- February saw a 4-month high in Iranian loadings at 1.47mbpd as late starters South Korea and Japan hurry to bring in as much crude as possible before the waivers run out.

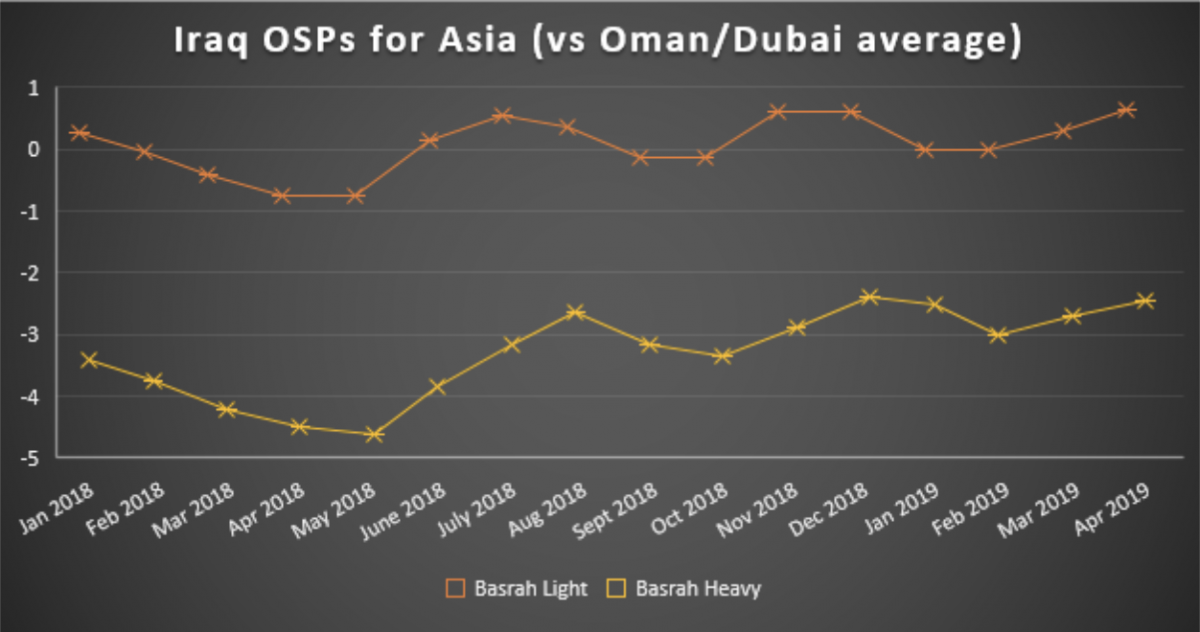

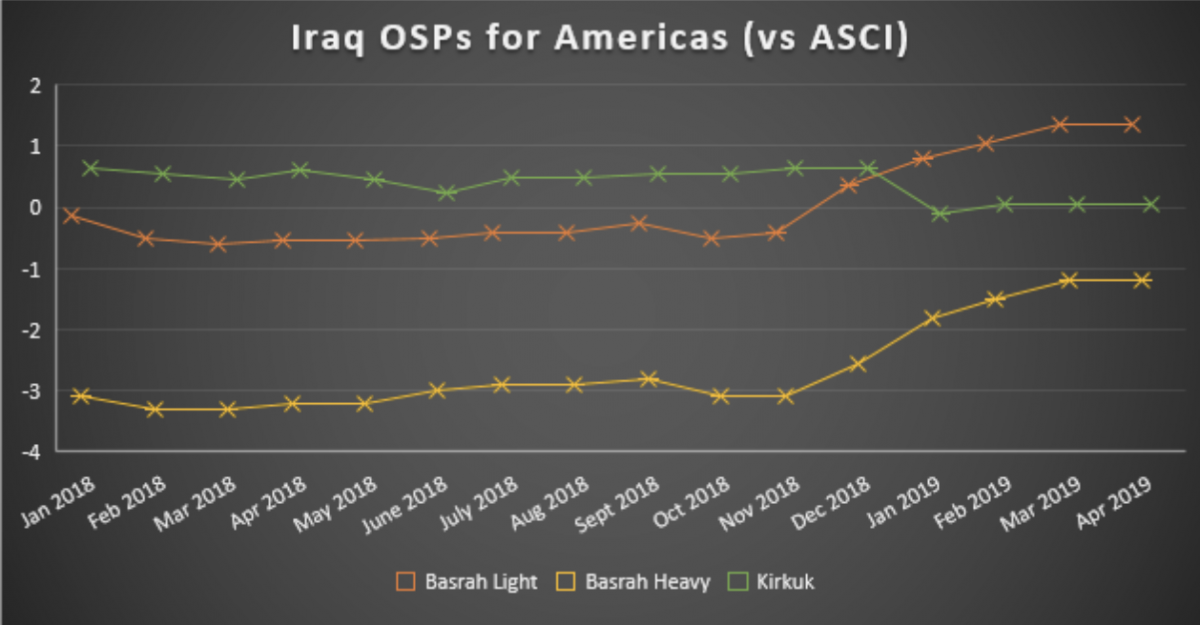

3. Iraq Hiking Asia OSPs for April

- Following in the footsteps of Saudi Aramco, Iraqi state oil marketer SOMO has cut all its April-loading official selling prices destined for Europe, while raising Asia-bound OSPs.

- Amid fears of backwardation on the Asian market growing, SOMO increased its Basrah Light and Basrah Heavy prices by 35 and 25 cents, respectively.

- European prices, however, were pressurized by the "normalization” (read: weakening) of Urals quotes in February-March, forcing SOMO to cut prices by 40-55 cents, with Basrah Light seeing the steepest cut of 55 cents to a 3.2 USD per barrel discount to Dated Brent.

- SOMO simply rolled over all its Americas-bound prices (in the case of Kirkuk for the third consecutive month already), even though Saudi Aramco dropped its Arab Extra Light OSP by 30 cents last week.

- Iraq’s February export levels dropped some 7 percent month-on-month to 3.86mbpd after Iraq finally moved closer to its OPEC/OPEC+ commitments and lowered aggregate output to 4.55mbpd.

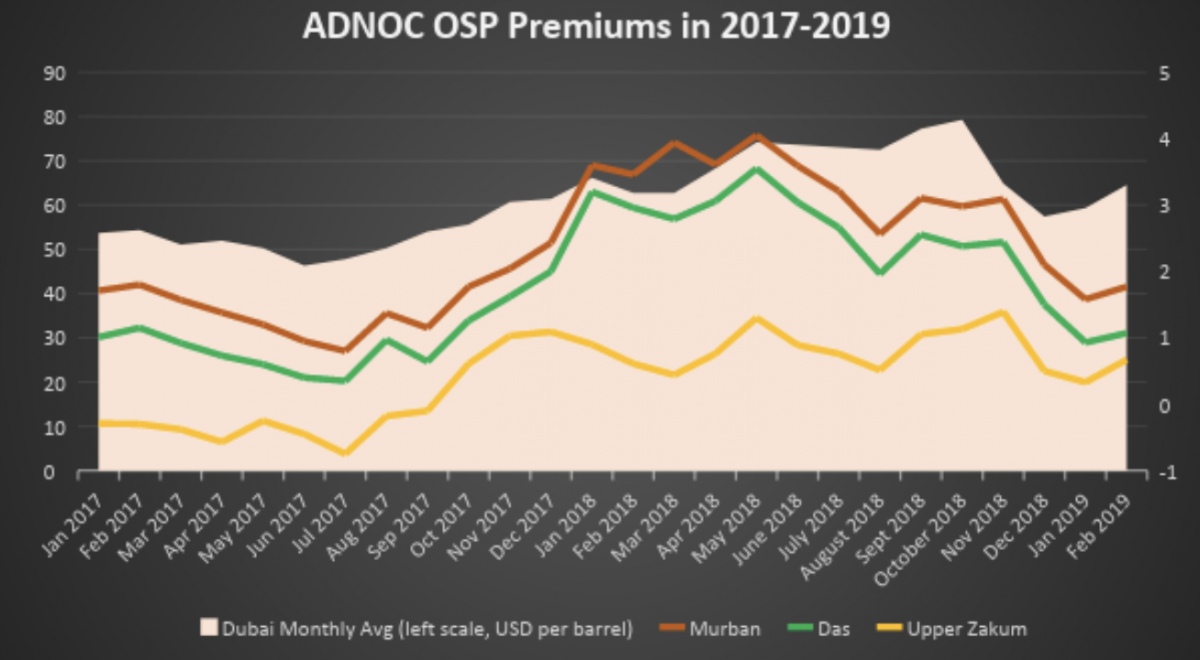

4. ADNOC Drops Light Grades in Retroactive February OSPs

- In line with the general trend of sour crudes rising in value and light ones depreciating slightly, main UAE producer ADNOC has cut the retroactive February official prices of its light sour grades, Murban, and Das.

- The Murban-Dubai premium was cut by 10 cents to 1.77 USD per barrel, while Das saw its February premium drop by 15 cents to 1.07 USD per barrel.

- Upper Zakum’s premium to Dubai was hiked by 5 cents to 0.67 USD per barrel, while most recent portfolio addition Umm Lulu saw its January OSP rolled over into February.

- So far there is little evidence to expect ADNOC grades bouncing back vis-a-vis the monthly Dubai average in March as refinery turnarounds and weak light distillate margins loom large for buyers.

- As of February 2019, the UAE was pumping 3.05mbpd of crude, some 20 000bpd below its OPEC/OPEC+ production cut pledge of 3.072mbpd.

5. US Production Growth Estimates Leave Analysts in Disarray

- The International Energy Agency (IEA) estimates the US will bring another 4mbpd production onstream in the next five years, leading global supply growth until 2024.

- The IEA expects the United States to overtake Russia and close in on Saudi Arabia as the second-largest crude exporter, with gross exports totaling 8.93mbpd in 2024.

- In the meantime, the US Energy Information Administration (EIA) cut its production outlook by 110kbpd for 2019 and by 170kbpd for 2020 due to lower expected output in the Gulf of Mexico and Niobrara.

- This would leave US production at 12.3mbpd this year, with a 0.7mbpd hike in 2020 to 13.03mbpd.

- The EIA sees Brent averaging 62.78 USD per barrel this year, staying at roughly the same level in 2020, with WTI prices hitting 56.13 USD per barrel in 2019 and then moving to 58 USD per barrel in 2020.

6. Shell Officially Moves Into Colombian Offshore

- Royal Dutch Shell and the Colombian government have signed two exploration and production deals covering the COL-3 and GUA OFF-3 blocks of Colombia’s deepwater offshore.

- Shell pledged to make initial investments of 100 million, potentially climbing even higher in case of drilling taps into substantial reserves of hydrocarbons.

- Colombia’s offshore sector witnessed two major discoveries – with Petrobras’ well Orca-1 (Tayrona block, estimated reserves of 425 BCf) and Anadarko’s Kronos (Fuerte Sur, estimated reserves of 325 BCf).

- Given the overwhelmingly gas-bearing character of the previous discoveries, Shell is betting on taking a gas position in the Caribbean as a profitable way forward.

- In the meantime, the Colombian government is preparing to offer 20 blocks, 18 onshore and 2 offshore, hoping to discover at least 1 billion barrels of oil (its reserves-to-consumption ratio is roughly six years).

- If the deepwater offshore (one of the last underdeveloped areas of the Latin American country) is anything to go by, ramping up gas reserves seems a much more plausible scenario for the future.

7. Nationwide Blackout Leaves Venezuelan Upstream in the Dark

- Not only Venezuela’s populace, but also its upstream and downstream segments have suffered greatly from the Latin American country’s prolonged blackout.

- Venezuela’s heavy crude upgraders, whose 450kbpd capacity guarantees the continuity of the nation’s exports, remained offstream as of Tuesday.

- Venezuelan authorities claim that the power outage at the Guri hydro energy complex was caused by a US malware attack.

- Venezuela’s main export outlet, the Jose terminal, was offstream for three days until March 11, it already saw action on Tuesday thanks to the restoration of the Barbacoa-Jose transmission line.