Friday July 12, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

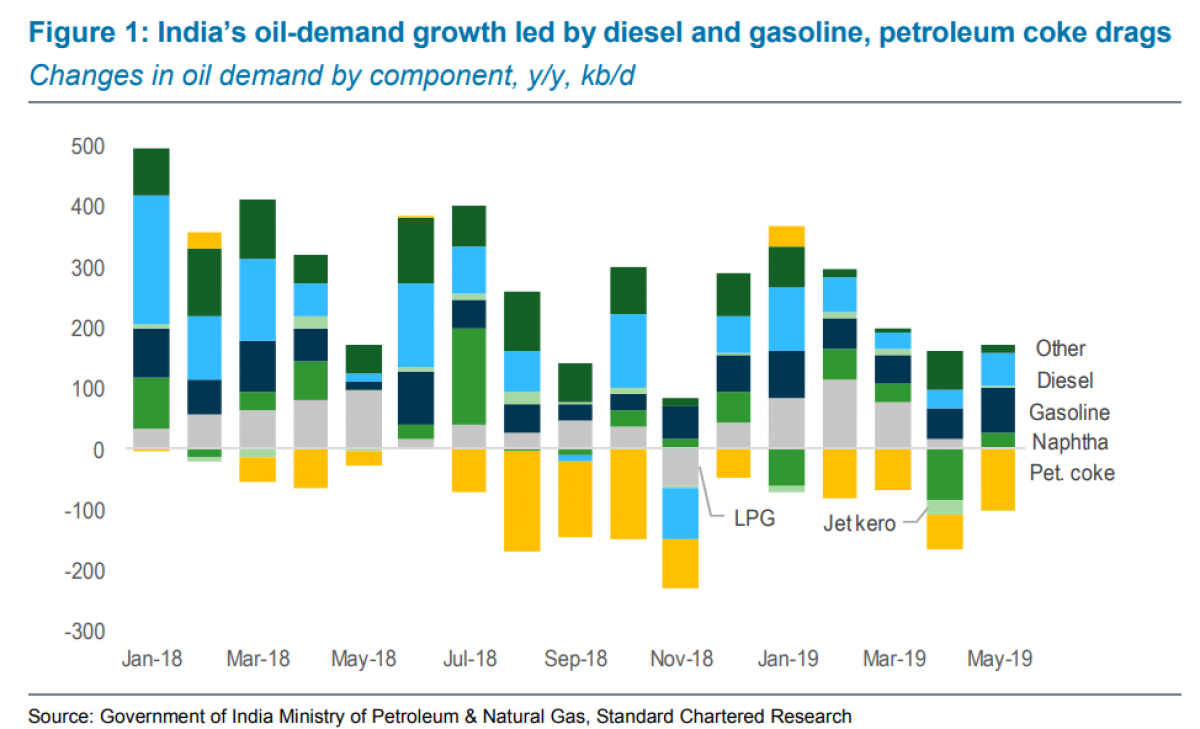

1. India oil demand disappointing

• The country widely expected to be the top source of demand growth for years to come – India – is posting some unimpressive growth figures.

• India is thought to see demand double between 2017 and 2040, growing 5.8 mb/d to reach 10.4 mb/d. The 5.8 mb/d increase exceeds China’s expected increase of 5.1 mb/d over the same time frame, which means India is the top source of demand growth.

• Over that same period, demand in OECD countries is expected to decline by 8.7 mb/d.

• In the short run, India’s importance is also on the rise. Over the past five years, India accounted for 16 percent of the global increase in demand, according to Standard Chartered.

• But this year, at least, India has disappointed. “After a strong start to 2019, India’s demand fell 0.1% y/y in April and rose just 1.5% in May, below our 2019 forecast of 4.3% (198kb/d),” the bank said.

2. Gold price increase driven by speculators

• Gold prices surged close to $1,420 per troy ounce in June and have zigzagged since then, hovering at about…

Friday July 12, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. India oil demand disappointing

• The country widely expected to be the top source of demand growth for years to come – India – is posting some unimpressive growth figures.

• India is thought to see demand double between 2017 and 2040, growing 5.8 mb/d to reach 10.4 mb/d. The 5.8 mb/d increase exceeds China’s expected increase of 5.1 mb/d over the same time frame, which means India is the top source of demand growth.

• Over that same period, demand in OECD countries is expected to decline by 8.7 mb/d.

• In the short run, India’s importance is also on the rise. Over the past five years, India accounted for 16 percent of the global increase in demand, according to Standard Chartered.

• But this year, at least, India has disappointed. “After a strong start to 2019, India’s demand fell 0.1% y/y in April and rose just 1.5% in May, below our 2019 forecast of 4.3% (198kb/d),” the bank said.

2. Gold price increase driven by speculators

• Gold prices surged close to $1,420 per troy ounce in June and have zigzagged since then, hovering at about the $1,400 level.

• “We blame profit-taking for the latest price weakness in the wake of Friday’s US labour market data,” Commerzbank said in a note. The strong jobs report led to speculation that the Federal Reserve might not cut interest rates as significantly as previously expected.

• “In our opinion, there was and still is considerable potential for profit-taking: since early June and until last Friday, gold ETFs had registered inflows of around 110 tons and speculative financial investors had expanded their net long positions by more than six-fold,” Commerzbank said.

• The bank went on to say: “At a good 194,000 contracts, net long positions were at their highest level on this reporting date since January 2018.”

• A certain amount of profit-taking is typical during an upswing, and does not mean that the price rally is over. Looser monetary policy and geopolitical risks could push gold higher, Commerzbank said.

3. China vehicle sales rise, easing fears

• China’s vehicle sales rose in June, temporarily easing market concerns about a sharp slowdown in the Chinese economy.

• Retail car sales rose by 4.9 percent to 1.8 million units in June, year-on-year. The news helped push up global equities.

• However, the sales were stoked by discounts as large as 50 percent as dealers looked to clear inventory ahead of new and stricter emissions standards, according to Bloomberg. “Short-term incentives like that boosted sales,” said Zhu Kongyuan, secretary general of the China Auto Dealers Chamber of Commerce.

• China is still on track to see a substantial decline in auto sales this year, with sales down more than 12 percent in the first six months of 2019.

• Meanwhile, electric vehicle sales are rising strongly, rising 80 percent in June from the same month a year earlier. Although starting from a small base, EV sales are growing briskly in a declining market, which means its market share is rising at an impressive rate.

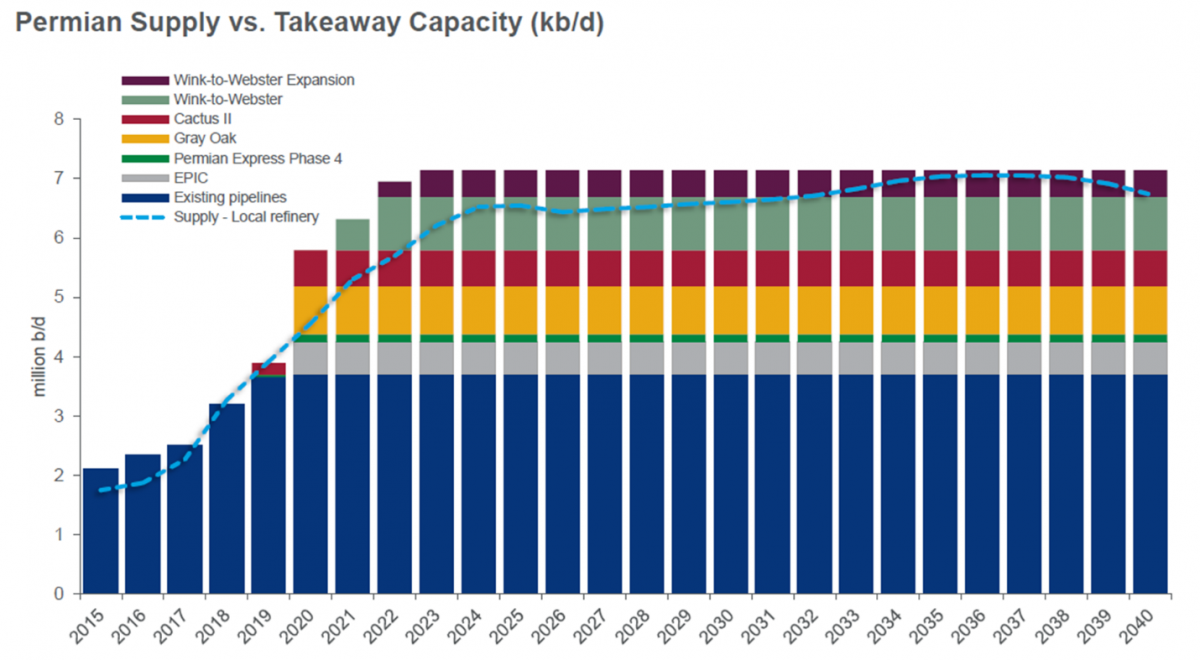

4. Permian pipelines unlock more growth

• The pipeline constraints in the Permian have led to painful discounts for oil in Midland, but new projects are set to come online that should pave the way for more production growth.

• Within the last two years, seven major pipelines were proposed by developers, with four moving forward with final investment decisions, according to Wood Mackenzie.

• The consultancy sees 3.5 mb/d of new Permian-to-Gulf-Coast capacity coming online by 2022, “effectively doubling long-haul capacity from the basin. This burst of buildout will likely lead to overcapacity short term,” WoodMac said.

• In its latest report, OPEC warned about the next wave of supply coming from the Permian after the pipelines come online. “With 2.5 mb/d of expected new pipeline capacity from the Permian to the USGC, production from the booming Permian Basin is forecast to grow without any constraints,” OPEC said.

5. Copper underperforms

• Commodities of all stripes have lagged behind the broader S&P 500, but copper has posted a particularly poor performance.

• Often called “Dr. Copper” because of its ability to diagnose the health of the global economy, the slide in copper prices is a red flag for economic health.

• Copper is crucial for a wide range of industries, used heavily in construction and manufacturing. Prices are down 11 percent since April, and are down in eight of the last 10 weeks, according to the Wall Street Journal.

• China is a major source of demand, so the negative readings on manufacturing activity in the last few weeks have dragged down copper prices.

• “Recession fears have triggered short selling among investors, further adding to price pressure,” Morgan Stanley analysts said in a recent note to clients.

6. Shale bonanza built by Wall Street

• Much of the U.S. shale industry is still not profitable, despite years of record-breaking production growth. In fact, the growth itself has crashed prices.

• However, the rapid expansion was only possible because Wall Street showered the industry in cheap capital.

• According to Kimmeridge Energy Management Co., and reported on by Liam Denning at Bloomberg Opinion, U.S. oil and gas production would have only grown at 2.7 percent per year between 2008 and 2018 if the industry had to fund operations with their own revenues and couldn’t tap external financing.

• But, investors poured money into the sector, allowing production to instead grow at an annual growth rate of 10.2 percent over the decade.

• Much of the production growth was not profitable, and now investors are pressuring companies to rein in their ambitions.

7. Clean energy investment falls sharply

• Spending on clean energy fell by 14 percent to $117.6 billion in the first six months of 2019 (year-on-year).

• The decline was largely because of the 39 percent plunge in spending in China, where the government phased out some clean energy subsidies.

• But the decline might be a one-off. “The slowdown in investment in China is real, but the figures for first-half 2019 probably overstate its severity,” Justin Wu, head of Asia-Pacific for BNEF, said in a statement. “We expect a nationwide solar auction happening now to lead to a rush of new PV project financings. We could also see several big deals in offshore wind in the second half.”

• BNEF noted that despite the half-year woes, the market saw the largest solar deal ever recorded. In Dubai, a $4.2 billion, 950-megawatt solar project was given the greenlight.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.