Friday, May 17, 2019

1. Nearing peak coal

- The number of final investment decisions (FIDs) for new coal plants has plunged over the last three years, falling from 88 GW in 2015 to just 22 GW in 2018, according to the IEA.

- As the Bloomberg chart shows, FIDs actually fell below the volume of coal that was shut down. About 30 GW of coal capacity was taken offline last year, the first time retirements exceeded new investment.

- With projects still coming online, coal generation is ticking up, but only slightly. As the queue gets worked through, peak coal demand will soon arrive.

- “This is a sneak preview of where we’ll be in three to four years’ time,” Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis, told Bloomberg. “If closures stay where they are, we’re at peak by 2021.”

2. Soybean prices hit 10-year low

- Soybean prices fell to a 10-year low following the increase of tariffs from both the U.S. and China, dipping to $7.55 per bushel this week.

- Prices initially plunged last year after China implemented the first round of tariffs on U.S. agricultural products, which came in response to American tariffs on Chinese goods.

- Margins on soybeans – the difference between the value of raw soybeans and the value of soybean meal and soybean oil – were near record highs last year, according to the EIA.…

Friday, May 17, 2019

1. Nearing peak coal

- The number of final investment decisions (FIDs) for new coal plants has plunged over the last three years, falling from 88 GW in 2015 to just 22 GW in 2018, according to the IEA.

- As the Bloomberg chart shows, FIDs actually fell below the volume of coal that was shut down. About 30 GW of coal capacity was taken offline last year, the first time retirements exceeded new investment.

- With projects still coming online, coal generation is ticking up, but only slightly. As the queue gets worked through, peak coal demand will soon arrive.

- “This is a sneak preview of where we’ll be in three to four years’ time,” Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis, told Bloomberg. “If closures stay where they are, we’re at peak by 2021.”

2. Soybean prices hit 10-year low

- Soybean prices fell to a 10-year low following the increase of tariffs from both the U.S. and China, dipping to $7.55 per bushel this week.

- Prices initially plunged last year after China implemented the first round of tariffs on U.S. agricultural products, which came in response to American tariffs on Chinese goods.

- Margins on soybeans – the difference between the value of raw soybeans and the value of soybean meal and soybean oil – were near record highs last year, according to the EIA. But they have since collapsed.

- JP Morgan said that U.S. agriculture is “rapidly deteriorating” into crisis, due to the combination of falling exports, a poor crop for corn and soybeans, and the trade war with China. “Overall, this is a perfect storm for US farmers,” J.P. Morgan analyst Ann Duignan said in a note to investors.

- Deere’s (NYSE: DE) stock has declined by 12 percent this month. JP Morgan downgraded the company’s stock to “underweight.”

3. Medium/heavy oil supply falls sharply

- The combination of mandatory production cuts from Alberta, the OPEC+ cuts, outages in Iran and Venezuela have significantly tightened the oil market. More specifically, those outages have taken supplies of medium and heavy grades offline.

- According to the IEA, medium and heavy blends have lost 3 mb/d since November. Dwindling output from Venezuela and major reductions in exports from Iran could add to that total.

- The apparent attack on oil tankers near the Persian Gulf this week, and the drone attack on a Saudi pipeline, highlight further geopolitical risk to medium-heavy supply.

- “Iran’s medium-heavy crudes can be replaced by similar grades from Saudi Arabia, Iraq, Russia and the UAE. As for condensate, Qatar and Australia are well positioned to step in,” the IEA said.

4. Oil stocks dip below 5-year average

- OECD commercial stocks fell by 25.8 million barrels in March, a large drawdown given that stocks have only declined by 4 million barrels on average for that month over the past five years.

- Sitting at 2,849 million barrels, stocks are now below the five-year average.

- In terms of days of forward demand, stocks are equivalent to only 59.8 days, the lowest level since July 2018, according to the IEA.

- Notably, the IEA said that the global oil market probably saw about 0.7 mb/d surplus in the first quarter, higher than previously thought.

- “As we move through 2Q19, while there is considerable uncertainty on the supply side, it is highly likely that the implied balance will flip into an indicative deficit of about the same size,” the IEA said.

5. Bitcoin skyrockets, falls back

- Bitcoin soared above $8,000 in recent days, up from around the $5,000 level at the start of the month. The cryptocurrency is on track to post its largest monthly gain since November 2017, at the height of the bull market.

- There are no rock-solid explanations for the latest rally. Once contributing factor is that momentum tends to feed on itself.

- Higher prices “triggered algos, stop losses and liquidations, which only added fuel to the buying pressure,” Jeff Dorman, chief investment officer of asset manager Arca, told Forbes.

- However, the rally was starting to look overstretched, with technical indicators suggesting a pullback is possible.

- Bitcoin prices crashed at the end of the week, falling 10 percent.

6. Will U.S. shale post positive cash flow?

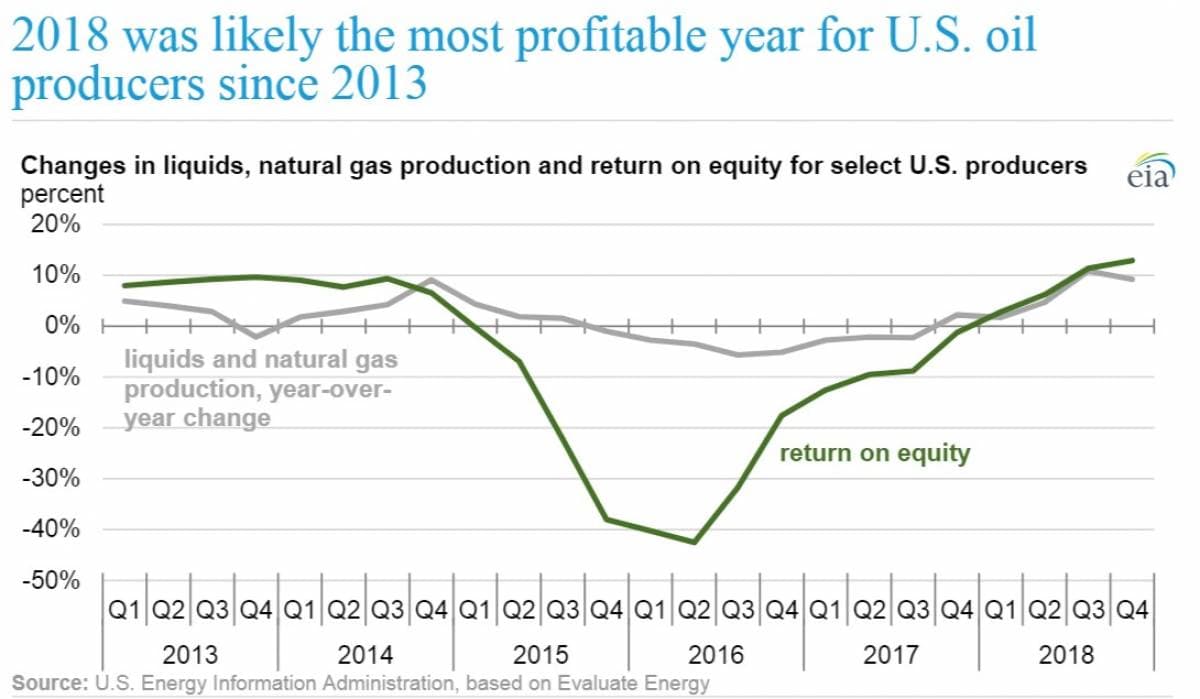

- Net income for 43 U.S. oil producers reached $28 billion last year, the highest level in five years, according to the EIA.

- Lower production costs, higher output, and a rebound in oil prices helped push quarterly return on equity to its highest level in years.

- The selection of companies surveyed by the EIA had expenses on the order of $48 per barrel, and revenues also averaged $48 per barrel.

- However, these figures include companies that have operations elsewhere in the world as well as offshore. U.S. shale, by and large, has yet to prove that it can consistently post positive cash flow.

7. Trade war to dominate metals markets

- Copper sold off sharply on renewed trade tensions in the past two weeks, completely erasing first quarter gains. As this Goldman Sachs chart depicts, copper has moved in tandem with China’s currency.

- The escalation of the trade war is negative for metals, and the downside risk has increased, especially in light of Trump’s threat to impose yet another round of tariffs on the rest of U.S. imports from China.

- “However, we think Chinese policymakers are likely to offset downside risks imposed by trade tensions with easing measures which tend to disproportionally benefit metal-intensive sectors such as property and infrastructure,” Goldman Sachs wrote in a note.

- As a result, copper looks “cheap at current levels,” the investment bank argued.