Friday October 4, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. manufacturing activity plunges

(Click to enlarge)

• Oil was ensnared in a global selloff midweek after fresh data pointed to a sudden and sharp contraction in U.S. manufacturing activity.

• The Institute for Supply Management said that the manufacturing PMI fell to 47.8, the worst reading in a decade. Anything below 50 means a contraction in activity.

• Global equities sold off, as did crude oil. The U.S. economy has been relatively healthy throughout 2019, despite a significant deceleration in China, Germany and elsewhere.

• Manufacturing is still a relatively small slice of the economy at around 10 percent. But if it bleeds over and leads to declines in consumer spending, the U.S. could be heading for a recession.

2. Palladium prices stay aloft

(Click to enlarge)

• Precious metals have lost quite a bit of value over the past month, but palladium has fended off the price correction and has stayed aloft.

• It’s not clear that defying gravity can last.

• “Because palladium has held its own better than any other precious metal and has declined…

Friday October 4, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. manufacturing activity plunges

(Click to enlarge)

• Oil was ensnared in a global selloff midweek after fresh data pointed to a sudden and sharp contraction in U.S. manufacturing activity.

• The Institute for Supply Management said that the manufacturing PMI fell to 47.8, the worst reading in a decade. Anything below 50 means a contraction in activity.

• Global equities sold off, as did crude oil. The U.S. economy has been relatively healthy throughout 2019, despite a significant deceleration in China, Germany and elsewhere.

• Manufacturing is still a relatively small slice of the economy at around 10 percent. But if it bleeds over and leads to declines in consumer spending, the U.S. could be heading for a recession.

2. Palladium prices stay aloft

(Click to enlarge)

• Precious metals have lost quite a bit of value over the past month, but palladium has fended off the price correction and has stayed aloft.

• It’s not clear that defying gravity can last.

• “Because palladium has held its own better than any other precious metal and has declined only slightly, platinum is now almost $800 cheaper than palladium,” Commerzbank said in a note. “The discount on the platinum price as compared to palladium has never been this high before.”

• Gold and palladium are testing record highs as investors grow nervous about the health of the global economy.

• “Gold will remain at the top of the precious metals leaderboard, and its performance [will] accelerate into year-end,” said Bloomberg Intelligence senior commodity strategist Mike McGlone, according to Kitco. “A definitive reversal in weakening global economic conditions should be needed to reverse this trend, yet further woes in 4Q appear the greater risk.”

3. The “Big LNG Short”

(Clcik to enlarge)

• A wave of LNG export projects hit a global market that was slowing down, and the ill-timed increase of supply helped crash prices around the world.

• Europe has been a dumping ground for excess gas, dragging down prices. As utilities switch from coal to gas, coal is being hit hard. European natural gas prices have averaged $4.1/MMBtu this summer, or about $1.5-$2/MMBtu cheaper than coal, according to Bank of America.

• Even still, natural gas inventories in Europe are at record levels.

• “If the global gas market exhausts European storage capacity in the coming weeks, relatively low LNG shipping rates could facilitate floating storage to help balance the market until cold weather shows up,” Bank of America Merrill Lynch wrote in a note called “The Big LNG Short.”

• The damage for gas suppliers could grow worse if cold weather doesn’t show up. “The global gas market is more connected than ever before, for better or worse,” Bank of America said. “A mild winter across the northern hemisphere or a worsening macro backdrop could be catastrophic for gas across all regions.”

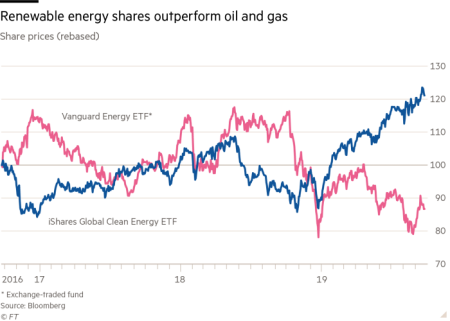

4. Renewable energy outperforms oil and gas

(Click to enlarge)

• Renewable energy has outperformed its fossil fuel competitors in stock returns this year.

• The iShares Clean Energy ETF has gained 32 percent this year, while the oil-heavy Vanguard Energy ETF is in negative territory after this week’s losses.

• Low interest rates also help. “Decarbonisation is the largest investment the world has ever had to make in peacetime and the yield curve is giving us an extremely attractive environment in which to make that investment,” Deirdre Cooper, who runs the Investec Global Environment fund, told the FT.

• Government policies are likely set to continue favoring clean energy globally, and could also take more punitive steps towards oil and gas. In that policy context, renewable energy could continue to make a stronger investment case.

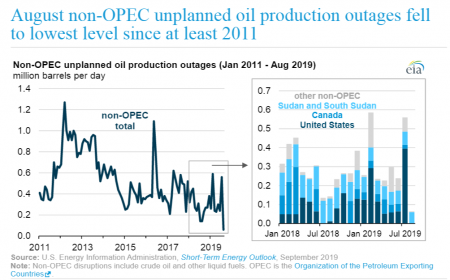

5. Non-OPEC outages at record low

(Click to enlarge)

• While the oil market was rightly focused on outages at the Abqaiq facility and what it meant for spare capacity, outside of OPEC global unplanned supply outages fell just 64,000 bpd in August.

• That is the lowest volume of disrupted output since the EIA began tracking the data in 2011. Sudan and South Sudan were the only oil producers outside of OPEC that had unplanned outages for the month.

• “The decline in non-OPEC unplanned outages may have contributed to the resilience of the global oil market following the disruption of almost 5.7 million b/d of Saudi Arabian crude oil production on September 14, 2019,” the EIA said.

• The outages from OPEC, however, spiked to a multi-year high after the Abqaiq attack. Still, repairs were swift and Saudi Arabia seems to have recovered most, if not all, of its pre-attack production.

6. Trump scrambles to help farmers

(Click to enlarge)

• The corn ethanol versus oil refining battle has been raging since the beginning of the Trump administration, but it took a new turn in August when the EPA issued 31 waivers to refiners, upsetting the market for ethanol and biofuels credits.

• The prices for renewable identification numbers (RINs), the credits traded to comply with federal mandates, plunged after the waivers.

• Enraged, farmers and biofuels groups have been demanding a fix. Several ethanol production facilities have closed this year because of the damage stemming from the waivers, which destroyed demand for ethanol.

• Recognizing that a worsening economic crisis for farm country risks the 2020 election, President Trump is set to roll out a new compromise in the coming days.

• It remains to be seen whether or not the proposal will be sufficient to repair the damage to ethanol producers and farmers.

• The problem is that there is a zero-sum battle with oil refiners, who met with the president recently to dissuade him from the ethanol rescue. It’s not clear that Trump can find a middle ground.

7. Diesel margins grow despite weakening demand

(Click to enlarge)

• Oil demand has weakened this year, but as we approach the January 1, 2020 date for new IMO regulations on high-sulfur fuels, the market for diesel is much more bullish than for other products. “In fact, diesel cracks have risen steadily since mid-year after being crushed by the ever weakening macro-economic backdrop,” Bank of America Merrill Lynch wrote in a note.

• The Abqaiq attack disrupted product exports, which “fueled fears of product scarcity globally, which lent support to broader product cracks, including diesel,” Bank of America said.

• The quick return of Abqaiq meant that product margins fell back, however, diesel margins held up.

• Diesel is more exposed to economic slowdowns than other products, due to its correlation with trade and industrial activity.

• But the IMO regulations will provide a boost for diesel, although a temporary one.

• “In 2020, we forecast demand for [high-sulfur fuel oil] will decline from roughly 3.2mn b/d to 1.3mn b/d as shippers opt for compliant fuels like [very-low sulfur fuel oil] and [marine gasoil],” Bank of America said. “Demand for middle distillates should see nearly 1mn b/d of additional demand due to MGO consumption and blending of middle distillates into the fuel oil pool.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.