Friday June 8, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- U.S. oil production rose to another record at 10.8 million barrels per day. Reported bottlenecks are still not showing up in the production data, but sharp price discounts suggest the region is suffering. The production data may only reflect these problems later on.

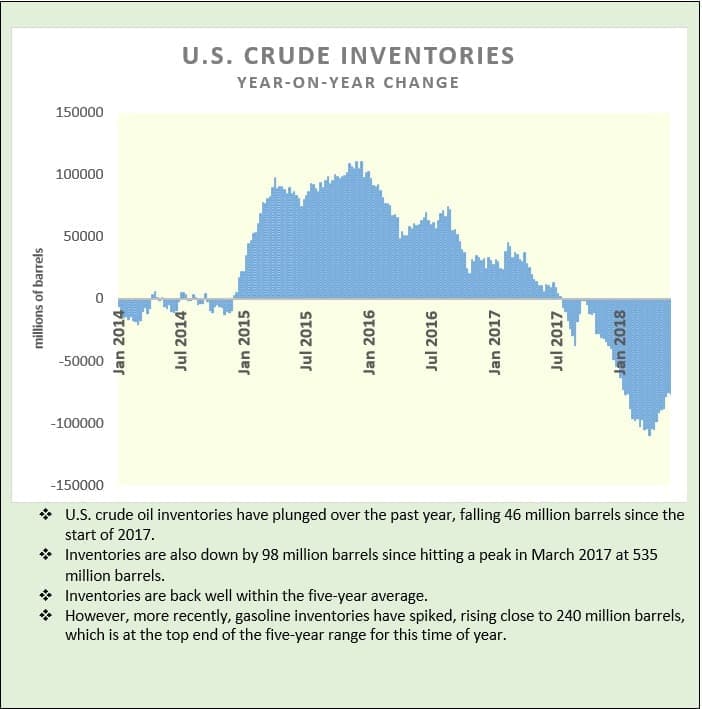

- A sizable increase in imports led to an increase in crude inventories.

- The big surprise this week was the enormous increase in gasoline inventories, a bearish sign.

1. Permian stocks falling out of favor

• Over the last few years, shale E&Ps fell over themselves to acquire as much Permian exposure as they possibly could, and the “pure play” Permian stocks were the darlings of Wall Street.

• That is changing. A Bloomberg analysis of 13 Permian-focused shale stocks found that their average price-to-earnings ratio (P/E) declined from 19 times to just 15.6 times over the past month.

• Permian drillers are actually now much less attractive than shale firms with exposure elsewhere.

• For instance, Parsley Energy (NYSE: PE) has seen its share price fall about 15 percent in the past month.

• But the…

Friday June 8, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- U.S. oil production rose to another record at 10.8 million barrels per day. Reported bottlenecks are still not showing up in the production data, but sharp price discounts suggest the region is suffering. The production data may only reflect these problems later on.

- A sizable increase in imports led to an increase in crude inventories.

- The big surprise this week was the enormous increase in gasoline inventories, a bearish sign.

1. Permian stocks falling out of favor

• Over the last few years, shale E&Ps fell over themselves to acquire as much Permian exposure as they possibly could, and the “pure play” Permian stocks were the darlings of Wall Street.

• That is changing. A Bloomberg analysis of 13 Permian-focused shale stocks found that their average price-to-earnings ratio (P/E) declined from 19 times to just 15.6 times over the past month.

• Permian drillers are actually now much less attractive than shale firms with exposure elsewhere.

• For instance, Parsley Energy (NYSE: PE) has seen its share price fall about 15 percent in the past month.

• But the deterioration of its relative position is even more eye-opening. It traded at a 29 percent premium to ExxonMobil (NYSE: XOM) a month ago, Bloomberg finds, based on P/E multiples, but is now trading at a 10 percent discount.

• The pipeline bottleneck in the Permian, which has forced steep discounts for oil in Midland, is weighing on the valuation of Permian drillers.

2. Flattening of futures curve

• The Brent futures curve has flattened out over the past month, a sign that oil traders have lost some bullish faith in the trajectory of the market.

• A price correction was due, not least because hedge funds and other money managers had gobbled up an astounding volume of net-long positions. Those bets started to unwind in April, setting the stage for a price correction.

• The premium for near-term deliveries relative to the next few months has narrowed. The August 2018 to August 2019 Brent spread traded at about $5.50 per barrel this week, a differential that is several dollars per barrel smaller than it was last month.

• The narrowing of the spread was occurring at a time when news reports suggested some cargoes in the Atlantic Basin were going unsold, a sure sign of a well-supplied market.

• A falling differential also tends to coincide with oil price declines, which is exactly what we saw when news surfaced that Saudi Arabia and Russia are looking to boost production in a few weeks.

3. Currency risk a problem for oil market

• The U.S. dollar has performed well over the past year, with the Federal Reserve steadily hiking interest rates.

• The monetary tightening is a risk to oil demand in two compounding ways. Higher interest rates weaken emerging market currencies relative to the U.S. dollar, making dollar-denominated crude oil much more expensive. A pricier barrel of crude could curtail emerging market oil consumption, where demand growth is the strongest.

• Second, a stronger dollar and higher interest rates also makes dollar-denominated debt much more painful in emerging markets, threatening broader economic growth. Argentina recently sought a bailout from the IMF as its economy was forced into dangerous territory from the strong dollar.

• A dramatic slowdown in emerging markets could upset global oil demand.

4. A return to fuel subsidies?

• Soaring oil prices, up until recently, was translating into higher fuel prices around the world. But the price increase in Brent oil, for example, was not entirely passed through to consumers.

• Governments around the world scrapped fuel subsidies when oil prices crashed in 2014-2015, a windfall for the public purse. However, now that prices are rising, governments are hiking subsidies again in order to mitigate the pain at the pump.

• According to Bank of America Merrill Lynch, Brent prices rose by about 40 percent since January 2017, but diesel prices, for example, only rose by about 15 percent in India and China. Diesel prices rose by less than 10 percent in Thailand and the Eurozone, and there has been no price change in Malaysia, for instance.

• Public largesse will limit the pain for consumers, and blunt the political fallout. But it will be enormously expensive and could “set the stage for increased government borrowing and a deteriorating debt profile,” BofA Merrill Lynch said in a research note.

• At the same time, it might offset some of the demand destruction expected. The bank says demand will decline by only 200,000 bpd if Brent were to average $80 per barrel instead of $70. The relatively small decline in demand is the result of the fiscal buffers offered by a variety of governments.

5. Mexican election could result in downstream spending

• Mexico’s presidential election is scheduled for July 1, and barring some radical unforeseen events, the winner is set to be leftist Andres Manuel Lopez Obrador.

• He has decried falling Mexican oil production, as well as the decline in refining. Mexico’s oil production peaked at 3.5 mb/d in 2004, and has been declining since.

• The nation’s refineries are also in poor shape. Refining throughput is running at about half of the 1.1 mb/d the country averaged between 2012 and 2017.

• That has increased Mexico’s dependence on U.S gasoline imports. In 2014, Mexico imported about 200,000 bpd of gasoline from the U.S., a figure that jumped to over 400,000 bpd last year.

• The new president has promised massive public investment in refineries, which, in theory, would lead to an increase in domestic production of refined fuels and a decrease in imports from the U.S., although the plan will take time to implement. U.S. Gulf Coast refiners won’t be pleased.

Heard on the Street

On the resurgence in offshore drilling success:

“Exploration is performing better now than it was when oil prices were above US$100 per barrel…Our preliminary analysis suggests that global exploration generated double-digit returns and created US$5 billion of value in 2017.” – Wood Mackenzie

A wave of OPEC supply, or more losses?

“We think it likely that the oil market will face the loss of 1.5 million barrels per day (mb/d) from current OPEC supplies by the end of 2018, 0.5mb/d from Venezuela and 1mb/d from Iran…Such a supply loss would strain global spare capacity and bias price risks to the upside.” – Standard Chartered

Demand in the driver’s seat:

“We continue to forecast 1.8 [mb/d] in 2018 global oil demand growth, ahead of the IEA forecast of 1.4 [mb/d]. Global GDP is tracking above 4.0%, supporting robust demand statistics in the US, China, India and Southeast Asia. Strong oil demand trends support our Brent forecast of $75-$80/bbl for the remainder of the year.” – Goldman Sachs

6. Permian running out of workers

• The unemployment rate in Midland, TX, the epicenter of the Permian Basin, has plunged to 2.1 percent.

• The basin is starting to see enormous upward wage pressure as drillers compete for scarce labor.

• Drillers are offering six-figure salaries to truckers and other ancillary services. This is pushing up costs of production, offsetting some of the efficiency gains for oil producers in recent years.

• The supply of homes for sale is at its lowest on record, Bloomberg reports, with prices averaging $325k, the highest since June 2014, which was a period that saw oil trade north of $100 per barrel.

• The shale industry is taking workers from other industries, with people in retail jumping ship to earn more money in the oil industry. That is leading to a shortage of workers in an array of non-oil industries in West Texas.

• The skyrocketing cost of living is also a problem for those not employed by the oil industry.

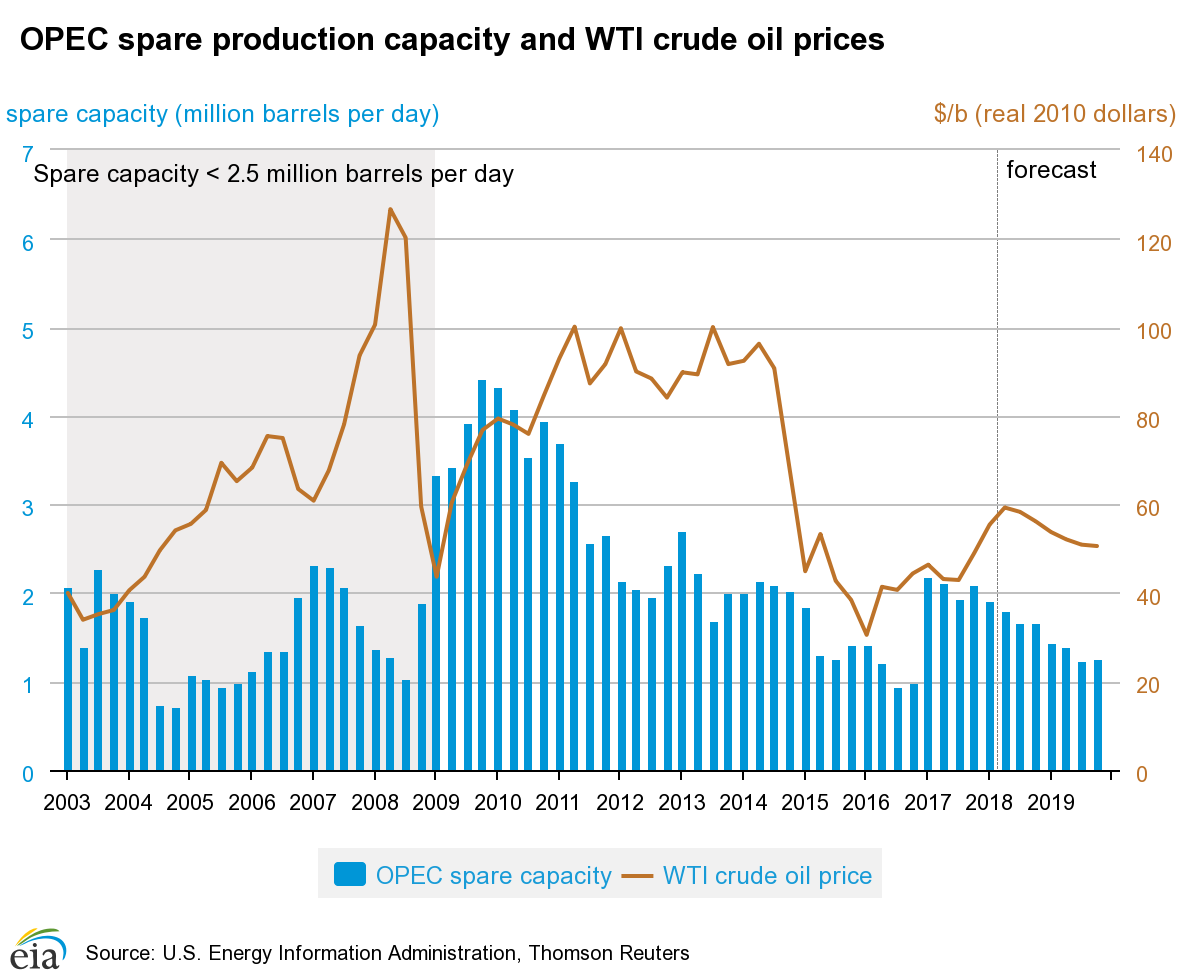

7. Higher OPEC production could cut into spare capacity

• The U.S. government reportedly asked Saudi Arabia and its OPEC/non-OPEC partners to add 1 million barrels per day of supply into the market in anticipation of outages in Iran.

• OPEC and Russia quickly voiced some sort of support for such a move, and oil prices promptly crashed when the news hit the market.

• However, if OPEC and Russia add 1 mb/d in new supply, it would come at the expense of spare capacity.

• The EIA estimates that spare capacity will average just 1.81 mb/d in the second quarter.

• A ramp up in supply could push spare capacity down to historically low levels.

• History suggests anytime spare capacity is low, oil prices are both high and volatile.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.