Crude prices dropped by the largest amount since July this week, decreasing by an average of 4-5% week-on-week despite a moderate rebound on Friday as the IEA alleviated concerns that the market will not be able to compensate for disappearing Iranian volumes. WTI traded around 72 per barrel on Friday, whilst Brent looked set to end the week at around 81 per barrel.

(Click to enlarge)

Both OPEC and the IEA have reported that the oil market is well supplied, with the latter even lowering its global oil demand growth estimate for 2018 and 2019 by about 110 000 bpd to 1.3 mbpd and 1.4 mbpd respectively. This, combined with a massive US stock sell-off and growing concerns that trade disputes will adversely impact oil have weighed on oil prices this week.

1. US Crude Stocks Keep on Rolling

(Click to enlarge)

- US commercial crude stocks increased 6 million barrels w-o-w amid a palpable decline in refinery throughputs, bringing total inventories to 410 million barrels.

- Refinery runs fell 352 kbpd last week to 16.2 Mbpd, with the aggregate throughput decline reaching 1.6 Mbpd over the past four weeks.

- Attesting to the highly volatile export volumes, reflecting the uneven loading schedules, exports jumped by 850 kbpd w-o-w to 2.6 mbpd, with net imports falling below 5 Mbpd for the first time since 2000.

- The impact of Tropical Storm Michael will significantly alter next week’s EIA weekly status.

- As Tropical Strom…

Crude prices dropped by the largest amount since July this week, decreasing by an average of 4-5% week-on-week despite a moderate rebound on Friday as the IEA alleviated concerns that the market will not be able to compensate for disappearing Iranian volumes. WTI traded around 72 per barrel on Friday, whilst Brent looked set to end the week at around 81 per barrel.

(Click to enlarge)

Both OPEC and the IEA have reported that the oil market is well supplied, with the latter even lowering its global oil demand growth estimate for 2018 and 2019 by about 110 000 bpd to 1.3 mbpd and 1.4 mbpd respectively. This, combined with a massive US stock sell-off and growing concerns that trade disputes will adversely impact oil have weighed on oil prices this week.

1. US Crude Stocks Keep on Rolling

(Click to enlarge)

- US commercial crude stocks increased 6 million barrels w-o-w amid a palpable decline in refinery throughputs, bringing total inventories to 410 million barrels.

- Refinery runs fell 352 kbpd last week to 16.2 Mbpd, with the aggregate throughput decline reaching 1.6 Mbpd over the past four weeks.

- Attesting to the highly volatile export volumes, reflecting the uneven loading schedules, exports jumped by 850 kbpd w-o-w to 2.6 mbpd, with net imports falling below 5 Mbpd for the first time since 2000.

- The impact of Tropical Storm Michael will significantly alter next week’s EIA weekly status.

- As Tropical Strom Michael passed through the US Gulf of Mexico, 40 percent of oil production and 29 percent of gas production there was locked in for a couple of days.

- Gulf production for the time of the tropical storm was down roughly by 680 000 bpd of oil and 744 MCfd of gas.

- As a result of the above, the average volume loss in October 2018 is estimated to hover around 100 kbpd.

2. Saudi Arabia Targets European Customers

Note: USD/barrel, set vs Oman/Dubai Average.

- Saudi Aramco has increased its Official Selling Prices (OSP) for all of its grades to be sold to Asian customers, with most grades returning to pre-September levels.

- Trademark grade Arab Light delivered to Asia increased to +1.7 USD per barrel, roughly returning to the +1.9 per barrel premium in August 2018.

- With its low September and October OSPs, Saudi Aramco tried to lure European and Asian buyers against the background of impending Iranian sanctions.

- Since October, the Asian OSPs are set against a 1st month DME Oman and Platts Dubai average – previously Saudi Aramco used the Platts Oman assessment which has largely grown irrelevant.

- Interestingly enough, OSPs for Saudi volumes destined for the United States went largely unchanged in the past three months.

- Saudi Aramco has significantly dropped premiums for NW Europe cargoes, after the steep hikes of October did not bring about the expected results.

- The average premium for Saudi grades to be shipped to the Mediterranean was cut by 30 cents per barrel.

3. Iraq Becomes OPEC’s Dark Horse

(Click to enlarge)

- Jabbar al-Luiabi was named the new head of Iraq’s INOC as the Middle Eastern country finally separates its oil business from the all-powerful Oil Ministry.

- Under the aegis of INOC, al-Luaibi will manage production throughout the country, incorporating the Basra Oil Company and North Oil Company.

- From 1987 until 2018, the Iraqi Ministry of Oil was both an operator and regulator – the new setup is a return to the pre-1987 system.

- Iraq boosted its output this year by some 200 kbpd to a current level of 4.6 mpd, which, buttressed by a more aggressive pricing policy (making use of the fact that their OSPs come out after Saudi Arabia has already set its prices), greatly reinvigorated the Iraqi oil industry.

- After Asia-bound Basrah Light moved lower than Arab Medium in October, SOMO seems intent on magnetizing European buyers in November.

- The national oil marketing company SOMO is still mulling any eventual change in its pricing – reportedly it analyzed Saudi Arabia’s implementation of DME Oman, but also keeps Shanghai INE futures as an option.

4. Asian Aframax freight market hit 2018 highs

- Freight rates for Asian crude transportation have peaked this week, with the Indonesia-Japan route up 12 percent on Thursday.

- Interestingly, it was only July 25 when Asian Aframax freight rates surpassed the W100 level for the first time in the year, since then freights have been on a upward curve.

- A plethora of factors is pushing freights up: Chinese independent refineries taking in more crude than usual, Iranian sanctions looming large on the horizon, as well as increased volumes from Russia and Saudi Arabia being pumped out to Asia.

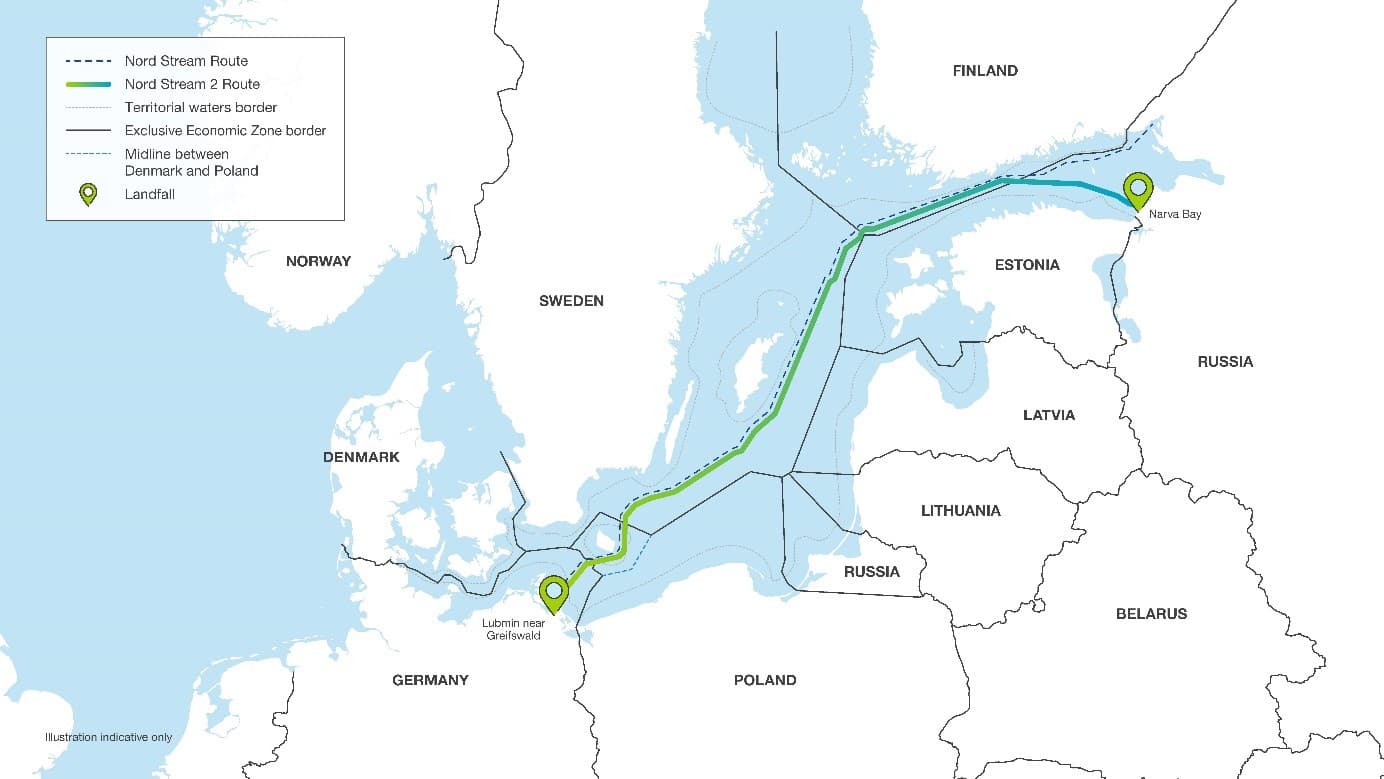

5. Nord Stream 2 To Be Built by Q1 2019

(Click to enlarge)

Source: Nord Stream 2.

- Just one month after pipelaying started on Nord Stream 2, the operator declared that 100km of the total 1224km had been already laid.

- Currently pipelaying is taking place in German and Finnish territorial waters, with three vessels belonging to Allseas (Solitaire, Audacia and Castoro Dieci) placing two 42-inch diameter gas pipelines to the seabed.

- Pipelaying in Russian territorial waters will start late November, whilst the 510km-long Swedish section will be started and completed in Q1 next year.

- Wary of further delays in Denmark where the decision to grant a construction permit has been pending since January 2018, Nord Stream 2 shareholders approved a new route around Denmark.

- The new route is roughly 10km longer and avoids Danish territorial waters, its construction will most likely take place in Q3 2019 after the new application is fully completed.

- There is still a slight likelihood that the Danish government approves the old route, however for reasons purely political Copenhagen would be better off with fast-tracking the new one amidst heavy German lobbying.

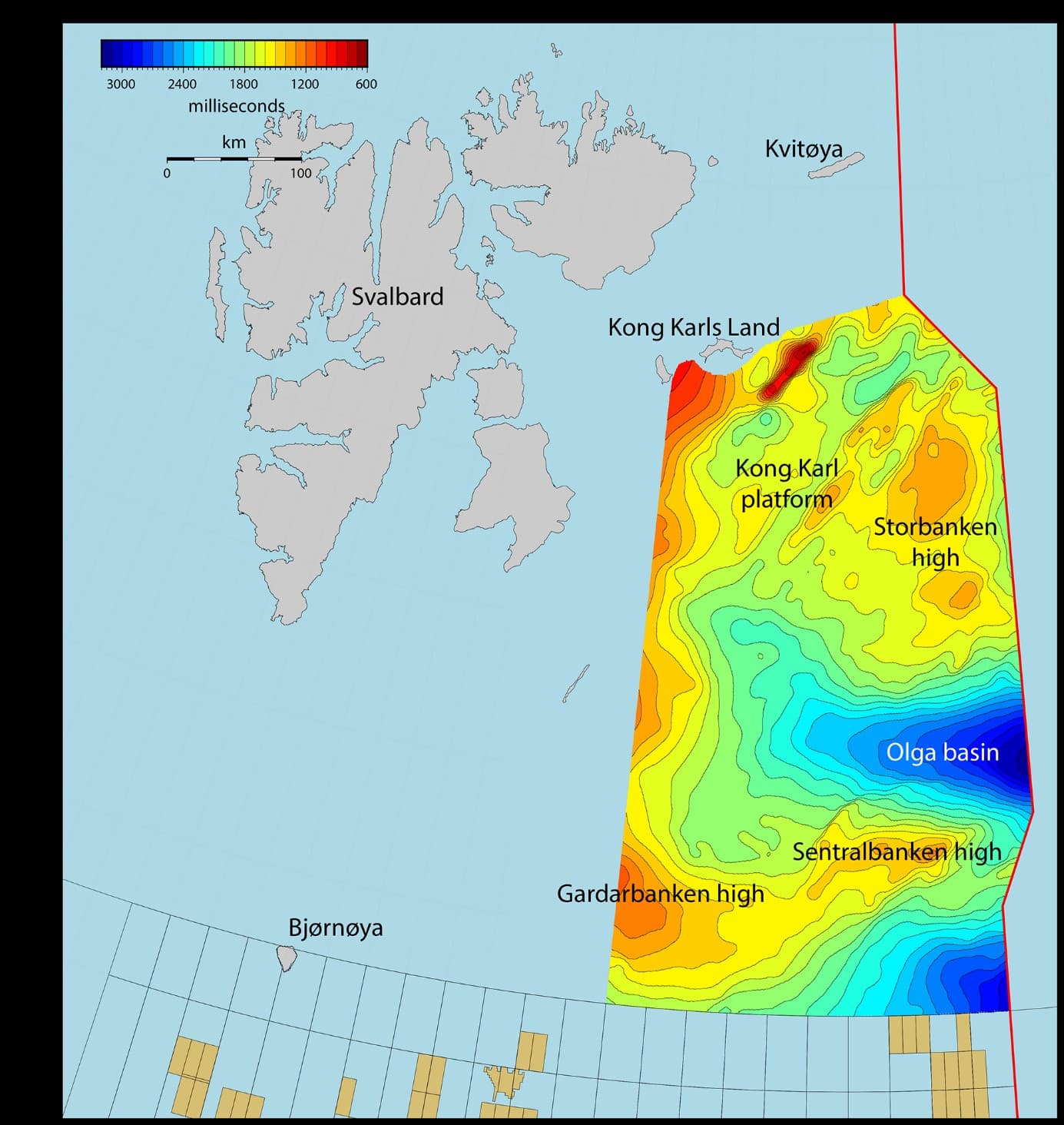

6. Norway Places Its Bets on Barents Sea

(Click to enlarge)

Source: Norwegian Petroleum Directorate.

- The Norwegian government initiated additional 3D surveying of Norway’s part of Barents Sea, straddling the border with Russia, fueling gossip that there might be a highly favorable find.

- The decision follows a 2017 Norwegian Petroleum Directorate report which found that Norway’s Barents Sea resources were twice as large as previously thought.

- With estimated reserves of 1.4 billion standard cubic meters of oil equivalent (of which roughly 60% is thought to be oil), 65% of Norway’s undiscovered reserves are now in the Barents Sea.

- The other side of the Norwegian-Russian border is fully under Rosneft’s control, with 3 massive licensed areas allocated to it – Perseyevsky, Tsentralno-Barentsevskiy and Fedynskiy.

- The territory was long considered problematic but the sides reached an all-encompassing agreement on its delimitation only in 2010.

- The first Norwegian well to be spudded in the former disputed zone, Equinor’s Korpfjell in 2017, turned out to be dry (only non-commercial amounts of gas discovered).

- Managing hydrogen sulfide will also prove to be a challenge for drillers – the Stangnesting acreage straddling the Russian Fedynsky block highlighted large concentrations of H2S.

7. NOVATEK Discovers Another Giant Gas Field

(Click to enlarge)

- NOVATEK has discovered another giant gas-condensate field, Severo-Obskoye, with estimated reserves of more than 320 BCm.

- The company expects that further drilling around the first spudded well, drilled with the Gazprom-owned Amazon rig, will bring total reserves to approximately 900 BCm.

- Located in shallow water of the Gulf of Ob, the field is ideally situated for another significant LNG project, preliminarily denoted Arctic LNG-3.

- The resource base for NOVATEK LNG pioneer, the 18.3 mtpa Yamal LNG, is the Yuzhno-Tambeyskoye field with estimated reserves of 926 BCm.

- NOVATEK’s second project, to be launched in 2022-2023, the 19.8 mtpa capacity Arctic LNG-2 will be fed from the 2 TCm Salmanovskoye field.

- With the discovery of Severo-Obskoye, NOVATEK is on a safe way to fulfill its aim of producing 55-57 mtpa of LNG by 2030, with more than a decade available to appraise new projects on the Gydan Peninsula.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.