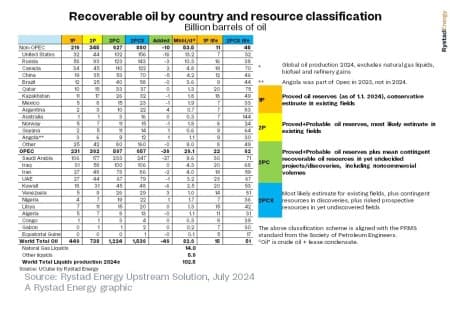

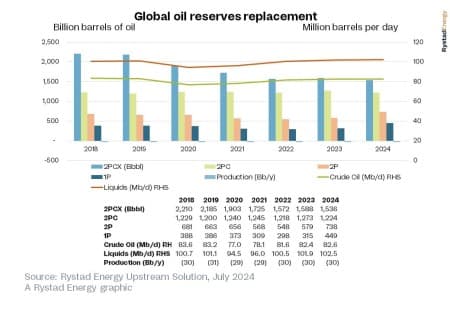

Rystad Energy’s latest research shows global recoverable oil reserves held largely steady at around 1,500 billion barrels, down some 52 billion barrels from our 2023 analysis. Of this year-over-year decrease, 30 billion barrels are due to one year of production, and 22 billion barrels are mostly due to downward adjustments of contingent resources in discoveries.

The largest downward revisions are seen in Saudi Arabia, where development priorities have shifted from offshore capacity expansions to onshore infill drilling. The only country with any significant increase in 2024 is Argentina, with a gain of 4 billion barrels thanks to the derisking of shale projects in the Vaca Muerta formation.

This total recoverable oil resource of 1,500 billion barrels gives an upper limit of how much oil can be produced over the next 100 years or more. Of course, this upper limit is only realistic and economical if oil demand is not impacted by the energy transition, meaning oil prices would rise far above $100 per barrel. In this theoretical “high case,” total oil production would peak around 2035 at 120 million barrels per day (bpd), then decline steeply to 85 million bpd in 2050.

Our estimates of total recoverable oil resources have fallen by 700 billion barrels since 2019 due to reduced exploration activities. Exploration has fallen as investors fear new discoveries will remain stranded due to the ongoing electrification of vehicles and the expected slump in both oil demand and crude prices.

Related: Oil Sinks as Signs of Tepid Crude Demand in Asia Multiply

“The world’s remaining oil reserves are insufficient to support oil demand if there is no transition to electric vehicles. Attempts to limit the supply of oil will have hardly any effect on limiting global warming. Instead, the only feasible way of keeping global temperatures rising less than 2.0 degrees Celsius is to ensure fast electrification of road transportation,” says Per Magnus Nysveen, Head of Analysis at Rystad Energy.

Our bottom-up data and analysis show that OPEC members hold 657 billion barrels of recoverable oil, equal to about 40% of the world's total, and well below the officially reported oil reserves of 1,215 billion barrels. These official numbers, as reported by OPEC member states in the BP Statistical Review 2022, could be inflated and overstated by almost double. Most overreporting comes from Venezuela, Iran, Libya and Kuwait, while Canada is the only OECD country that apparently overstates oil reserves, where most oil sand resources will remain stranded because of elevated development costs.

The top five countries with the most recoverable oil remain the same as in 2023. Saudi Arabia tops the list with 247 billion barrels, followed by the US with 156 billion barrels. Russia has 143 billion barrels, Canada has 122 billion barrels and Iraq with 105 billion barrels round out the top five. Latin American countries fared quite well compared to other regions, with Brazil, Mexico, Argentina, Guyana and Venezuela all staying relatively flat or growing marginally.

The total remaining reserves indicate that the upper level for further global warming caused only by oil consumption is 0.2 degrees, plus or minus 30% (standard deviation) due to uncertainties when modeling carbon budgets. This warming calculation assumes one barrel of oil emits 400 kg of carbon dioxide (CO2), 85% of oil is burnt and 222 gigatonnes of CO2 emitted leads to 0.1°C warming (IPCC AR6 SPM D.1.1: "best estimate for TCRE is 0.45 degree per 1000 GtCO2"). Methane emissions are disregarded.

In a more realistic outlook for oil production, total output would peak in 2030 at 108 million bpd and decline to 55 million bpd in 2050, with oil prices staying around $50 per barrel in real terms. Under this scenario, about one-third of the world’s recoverable oil, 500 billion barrels, would become stranded due to unprofitable developments. Such an aggressive energy transition scenario would theoretically limit global warming to 1.9 degrees, but given the current trajectory of oil demand, this path seems unlikely.

Rystad Energy also reports proven oil reserves at 449 billion barrels, according to recognized standards. This provides a lower limit for remaining oil reserves if no new development projects were to be approved and all exploration activities were stopped. This is a significant upward revision since 2023 driven by increased onshore infill drilling in Saudi Arabia.

This updated research from Rystad Energy is timestamped as 1 January 2024. In other words, our analysis illustrates where the remaining recoverable resources of each country stood at the beginning of this year.

ADVERTISEMENT

By Rystad Energy

More Top Reads From Oilprice.com:

- U.S. Crude Oil Inventories Continue to Fall

- European Natural Gas Prices Fall as Freeport LNG Resumes Operations

- Major Automakers Returning to Gasoline Cars as EV Demand Slows

As a result the OPEC producers suffered a huge reduction in oil export revenues forcing them to over produce to compensate. At that point Saudi Arabia abandoned its role as swing producer then and began producing at full capacity creating a huge surplus that resulted in a sharp fall in oil prices to $7 a barrel.

This forced OPEC to introduce a production quota system for its members based on their production capacity and proven reserves. Members immediately claimed higher proven reserves in order to qualify for a bigger production quota in what become known as political reserves. And these unreliable reserves became the standard reserves that were quoted year after year by BP Statistical Review of World Energy.

Therefore, I am not surprised that OPEC proven reserves could have been inflated but nobody can prove by how much until a proper assessment by independent experts is carried out and that could take years. However, the declining Saudi production is the first evidence.

And with declining global investments in oil exploration and capacity expansion since 2019 under pressure from Western green policies, it is possible that total recoverable oil resources may have fallen by 700 billion barrels since 2019.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert