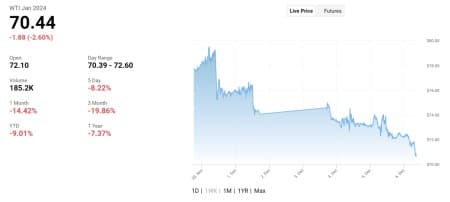

WTI oil prices held just above $70 today after the U.S. Energy Information Administration reported a crude oil inventory draw of 4.6 million barrels for the week to December 1.

A sizeable inventory build in gasoline and a smaller one in distillates, however, offset the crude draw.

The crude inventory draw followed a weekly estimated inventory build of 1.6 million barrels for the previous week.

A day before the EIA released its latest estimate, the American Petroleum Institute reported its own estimate showed an inventory build in crude oil and in fuels over the week to December 1, which sent oil prices even lower.

Per the EIA, fuels last week booked inventory increases.

In gasoline, the authority reported an estimate inventory build of 5.4 million barrels for last week. This compared with a build of 1.8 million barrels for the previous week.

Gasoline production in the week to December 1 averaged 9.5 million bpd, which compared with 9.3 million bpd for the previous week.

In middle distillates, the EIA estimated an inventory build of 1.3 million barrels for the week to December 1. This compared with a sizeable and much needed increase of 5.2 million barrels for the previous week.

Production of middle distillates averaged 5.1 million bpd last week, which compared with 5 million bpd for the previous week.

Oil prices meanwhile remain torn between bulls and bears as the market absorbs the implications of the latest production cuts from OPEC+ and mulls over the prospects of Chinese energy demand growth.

Some analysts are quite pessimistic. “The only positive news over the last couple of days has been Saudi and Russian officials stating that the OPEC+ cuts could be extended or deepened depending on market situations prevailing,” DBS Bank analyst Suvro Sarkar told Reuters.

Others, such as Vandana Hari from Vanda Insights, argue that the commodity is oversold.

“Crude has been oversold,” Hari told Bloomberg. “It’s hard to imagine it’s still reeling from the shock of the OPEC+ decision.”

ADVERTISEMENT

WTI front-month futures are now trading almost 15% lower than 30 days ago and saw little change following the release of the EIA inventory report.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia Cuts the Price of Its Flagship Crude for Asian Buyers

- Venezuela Orders “Immediate” Start of Oil Exploration in Disputed Territory

- The U.S. Wants to Halve Russia’s Oil and Gas Revenues by 2030