Shareholders would like to know whether the Obama administration’s climate change policy will be a positive or negative turning point for nuclear power giant Exelon Corp. (EXC).

Well, it couldn’t get any worse, at least. Chicago-based Exelon has lost $30.5 billion in market value and has seen its stock drop 64% over the past five years.

One view is that Exelon was playing a long game, betting on eventual limits to greenhouse gas emissions and being patient enough—and brave enough—to make its shareholders suffer five years of losses on this bet. A February dividend cut was the icing on this nuclear cake.

Related article: Nuclear Energy Innovation is Vital for Slowing Climate Change

Exelon will now—finally—benefit from the Obama administration’s new climate policy, so all that lobbying for climate legislation may start to pay off.

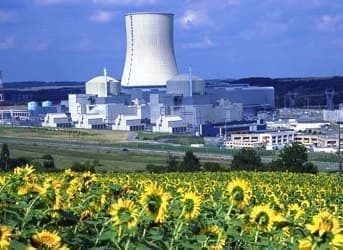

Specifically, the new climate policy unveiled this week will limit carbon dioxide emissions from power plants, which in turn could give Exelon and its nuclear reactors the advantage (not to mention alternative energy companies) over coal producers. Power plants are, after all, responsible for 40% of all greenhouse gas emissions.

By comparison to its coal-heavy competitors, Exelon only emits 25% of greenhouse gases to produce the same amount of power.

But investors will take note that nuclear energy was given exactly the right amount of play in Obama climate strategy, not overshadowing alternative energy, but letting investors know that it will be supported.

The market hasn’t reacted--yet. Exelon’s share prices declined 0.8% at the close of trading on 1 July, though they have overall gone up about 4.5% this year, according to Bloomberg.

ADVERTISEMENT

By. Charles Kennedy of Oilprice.com