Breaking News:

Transatlantic Energy Highway: Is a Global Power Grid on the Horizon?

Renewable energy variability poses challenges…

Asia's Rising Emissions Offset Western Climate Progress

Western efforts to reduce carbon…

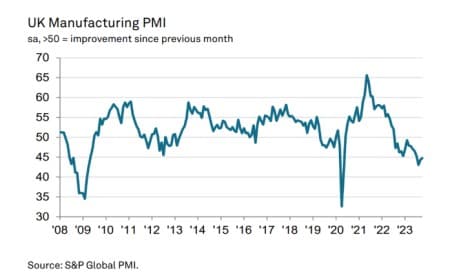

UK Manufacturing Faces Worst Downturn Since 2008

The UK’s manufacturing sector is engulfed in the deepest downturn since the 2008 financial crisis as market uncertainty depresses activity, a closely watched survey suggests.

According to the Chartered Institute of Procurement & Supply (CIPS) the UK manufacturing purchasing managers index (PMI) recorded 44.8 in October, with the 50 mark separating growth from contraction. Although this was an improvement on last month’s figure of 44.3, it was revised down from last week’s initial October estimate of 45.2.

This meant production fell for the eighth successive month – the longest sustained run of contraction since 2008/09.

The survey pointed to lower new orders, falling output and declining stocks of purchases. Delivery times also improved, which is normally a sign of weak demand. Exports meanwhile fell for the twenty-first successive month as firms suffered from weaker demand from Europe, China and Brazil.

“Companies are finding trading conditions difficult as they face headwinds from client destocking, market uncertainty and the impact of the cost-of-living crisis on consumer demand,” Rob Dobson, Director at S&P Global Market Intelligence, said.

Manufacturing in almost all major economies has been contracting for many months now. Slow growth in China has dented demand while consumers have increasingly prioritised spending on services rather than goods post-pandemic.

Rising interest rates are also putting cost pressures on businesses with experts suggesting the downturn has further to run. “We doubt that manufacturing output will start to recover until early next year,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics said.

For the thirteenth month in a row, manufacturing firms continued cutting jobs, the survey showed, although the rate slowed slightly compared to previous months.

Inflationary pressures may be easing as selling prices decreased for the fourth time in the past five months. But Dobson said “this brighter inflation outlook comes at the cost of increased recession risk, being a symptom of the broader weak demand malaise”.

ADVERTISEMENT

By City AM

More Top Reads From Oilprice.com:

- Researchers Unveil Catalyst To Convert CO2 Into Methane

- Europe’s Renewables Landscape Transforms With Rooftop Solar Adoption

- Armenia Faces Russia's Economic Might As Tensions Rise

City A.M

CityAM.com is the online presence of City A.M., London's first free daily business newspaper. Both platforms cover financial and business news as well as sport and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B