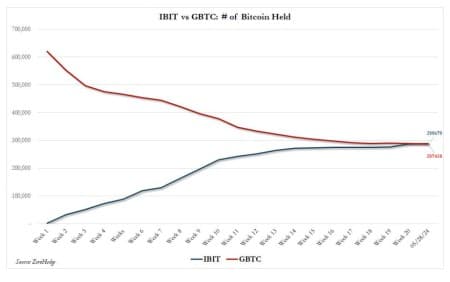

A month and a half after we first observed that the world's largest bitcoin fund, Grayscale's GBTC, had lost more than half of its assets since the approval of spot bitcoin ETFs in January in what was the year's first, and far less memorable "halving" event...

... and just over a week after Grayscale CEO Michael Sonnenschein unexpectedly resigned amid persistent, relentless outflows (courtesy of GBTC's 1.5% in fees), the flipping has officially taken place.

With today's ETF flows now in the books, the inevitable has finally happened, and after GBTC saw $105.2 million, or about 1530 bitcoin, withdrawn in its biggest one-day outflow in more than two weeks, while BlackRock's IBIT added $101.9 million, the latter has now surpassed the former, and Blackrock's IBIT has dethroned GBTC as the world's largest ETF with $19.795 billion in bitcoin, equivalent to roughly 288,670 bitcoin, vs $19.758 billion for GBTC.

And so having taken over the crown as the world's largest bitcoin ETF, Larry Fink can focus on the one asset he is truly after in his pursuit of financial tokenization - ether - which just got spot ETF approval late last week, and which Blackrock will very soon dominate as the 2nd largest cryptocurrency sets off in its trek to hit $14,000 some time in 2025 with Larry Fink's blessing.

By Zerohedge.com

More Top Reads From Oilprice.com:

- India's Largest Refinery Inks Russian Oil Deal

- ConocoPhillips to Buy Marathon Oil in $22.5-Billion All-Stock Deal

- Signs of Weakening Oil Demand in China Multiply