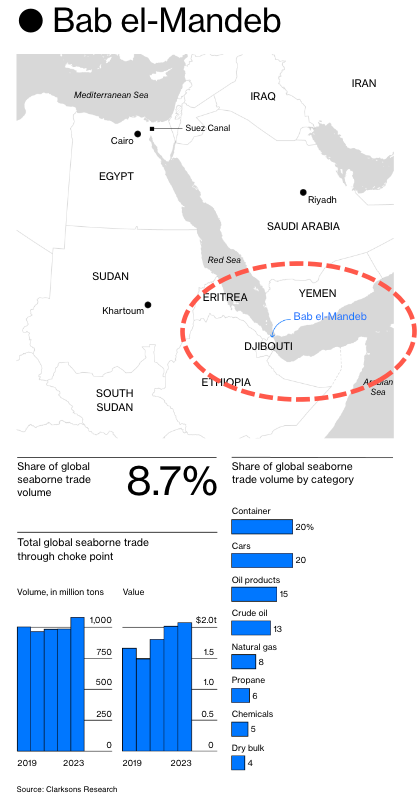

Iran-backed Houthi rebels have been intensifying missile and drone attacks, targeting commercial vessels in the southern Red Sea, critical Bab el-Mandeb chokepoint, and the Gulf of Aden. The rebels have even threatened to extend their reach to the Mediterranean Sea. The recent sinking of the Tutor dry-bulk carrier by a kamikaze drone boat marks a significant escalation. The ongoing turmoil has sent containerized freight costs soaring, along with insurance costs back on the rise.

Bloomberg spoke with two individuals familiar with the maritime insurance market. They said the price of covering a commercial vessel for transit has jumped from .3% to .4% of the ship's total value to .6%. In other words, a vessel worth $50 million must pay upwards of $300k of insurance for one sail.

"The rate is nevertheless slightly below a peak reached earlier this year when attacks ramped up," Bloomberg said. But if Houthi attacks persist through summer, the rate will likely increase further.

The sinking of the commodity-hauling bulk carrier this week by a drone boat was a real eye-opener for the shipping community and commodity industry as President Biden's Operation Prosperity Guardian fails to counter endless Houthi attacks on commercial ships in the critical shipping lane.

It was also the first time a ship was sunk by a drone boat in this muti-month campaign by Houthis.

"It's another indicator that the Houthis are stepping up their attacks on those vessels that were warned not to pass through the Red Sea," Dirk Siebels, a senior analyst at Risk Intelligence, said of the drone boat attack on Tutor, who Bloomberg quoted.

Considering Houthis are mainly targeting Western-linked vessels, not all insurance costs have soared. Bloomberg said Chinese vessels continue to receive significant discounts.

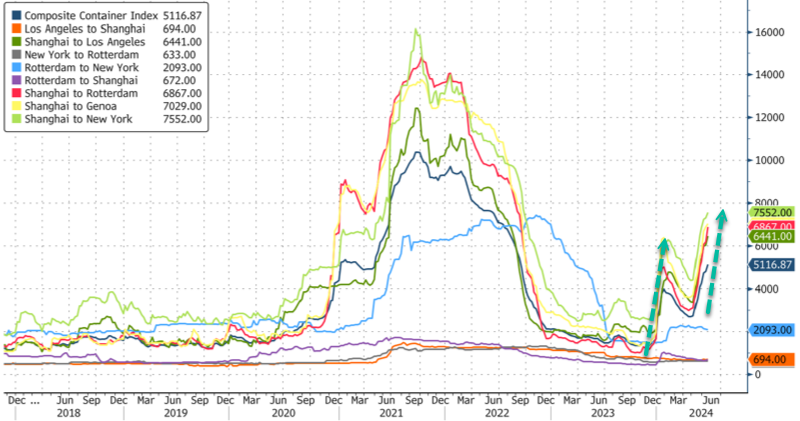

In addition to the rising insurance costs, the diversion of vessels from the Red Sea around the Cape of Good Hope is causing containerized shipping costs to skyrocket.

This shift is straining the world's containerized capacity, leading to a significant increase in shipping costs for 40-foot containers. Logjams are also forming at some of the world's top ports, including the Port of Singapore.

Samuel Cranny-Evans, an associate fellow at RUSI, a London-based think tank, warned drone boats "can be difficult to intercept."

That said, increasing insurance premiums and freight costs contribute to the sticky inflation story. Thanks, Iran, which is just causing turmoil on the maritime lane via its proxy group, Houthis.

ADVERTISEMENT

"Iran is defeating US deterrence and counterstrike in the Red Sea. The stage is set for a similar fight in the Gulf," David Asher, a senior fellow at Hudson Institute, stated, as war risks are only rising.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Natural Gas Outlook Mixed Amid Volatile European Markets

- Houthis Release Dramatic Video Of Bulk Carrier Being Blown Apart In Red Sea

- South Korea Warns Russia Over Military Pact with North Korea