Global investment in renewables including electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps will clock in at $2 trillion in the current year, twice the amount that will go into fossil fuels, the International Energy Agency has projected. This marks the second consecutive year when combined investment in renewable power and grids will surpass the amount spent on fossil fuels, having done so for the first time in 2023.

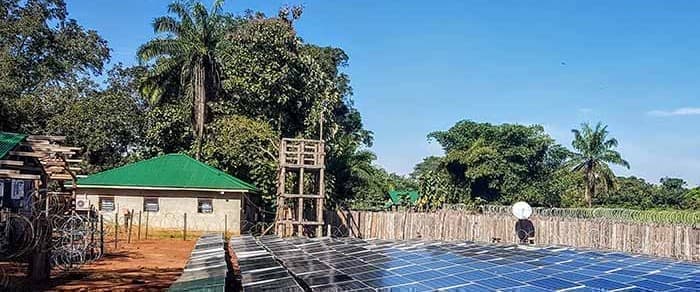

This is an encouraging trend for a sector that has been struggling with high interest rates and Big Oil companies scaling back their clean energy investment targets. Still, the IEA has warned that there are major imbalances and shortfalls in energy investment flows in many parts of the world. To wit, the entire African continent is set to receive just $40 billion of that $2 trillion clean energy bounty, with another $70 billion flowing into fossil fuels. That’s far short of the $200 billion annual investment the continent needs through 2030 to achieve its climate goals. Africa spends just 1.2% of its GDP on energy investments, considerably lower than the global average of 1.8% of GDP.

“Our tracking of energy spending suggests that around USD 110 billion is set to be invested in energy across Africa in 2024, of which nearly USD 70 billion to fossil fuel supply and power, with the remainder going to a range of clean energy technologies. Spending trends vary widely across Africa, but neither the total amount nor the proportion spent on clean energy is enough to put the continent on track to reach its sustainable development goals,” the report stated.

Related: Goldman Sachs Sees Oil Prices Rising to $86 This Summer

Although Africa contributes just 4% of global greenhouse gas emissions, the continent is expected to bear more than its fair share of the brunt of climate change. According to the International Rescue Committee, 7 of 10 of the most vulnerable countries to climate are African. Africa is home to ~17% of the world’s population; in contrast, the richest 10 percent of the world’s population is responsible for more than half of all carbon emissions.

As expected, the lion’s share of clean energy investments will go into China, reaching an estimated $675 billion thanks to strong domestic demand across solar, lithium batteries and electric vehicles sectors. Europe and the United States follow, with clean energy investment of $370 billion and $315 billion, respectively. This implies that these three major economies will gobble up more than two-thirds of global renewable energy investments in the current year.

Upstream Investments Enough To Meet Peak Oil Demand In 2030s

For years, oil and gas industry experts have fretted that the clean energy transition will limit capital spending on fossil fuels to a point where supply will be curtailed before demand slackens off. Well, that IEA report has come up with an interesting finding: Oil and gas investment in 2024 is broadly aligned with the demand levels implied in 2030 by today’s policy settings. According to the report, global upstream oil and gas investment is expected to grow by 7% in 2024 to hit $570 billion, with spending predominantly by national oil companies (NOCs) in the Middle East and Asia.

The IEA report is closely corroborated by another report released by global research and consultancy group Wood Mackenzie in 2023 that found that the current global annual investment clip of ~$500 billion into upstream oil and gas is sufficient to meet peak oil demand in the 2030s. According to WoodMac, this will be achieved through 3 main routes: the development of giant low-cost oil resources, relentless capital discipline and a transformational improvement in investment efficiency. WoodMac expects oil demand to peak at 108 million barrels per day (bpd) in the early 2030s before entering a phase of long-term decline.

The IEA is less sanguine about the timing of peak oil, and has predicted that global oil demand will reach a zenith before the end of the current decade as the transition to renewable energy gains momentum. The Paris-based energy watchdog has predicted that global oil demand will rise by another 6% from 2022-28 to hit 105.7 million barrels per day. The IEA sees global demand for oil used in transportation starting to decline in 2026, thanks in large part to the EV revolution as well as policy measures that push for more efficiency. However, the agency has predicted that demand for “combustible fossil fuels” will continue growing a little longer before peaking in 2028.

The IEA sees long-term oil demand degrading really badly and has predicted demand will fall to just 24 million barrels per day by 2050.

ADVERTISEMENT

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Start the Week With a Slight Gain but Uncertainty Remains

- Nigeria to Spend Nearly $4 Billion on Fuel Subsidies This Year

- Oil Price Outlook More Bullish Than Selloff Suggests: Fund Manager